Apple adopts new app pricing tiers, Chinese users to pay more

Apple users in China may no longer be buying apps that cost 99 cents in the US for 6 yuan because the company is adopting new pricing tiers in several of its international App Stores.

According to the new pricing scheme Apple has provided to its developers, the minimum price of applications in China will go up from 6 yuan to 8 yuan ($1.30). The minimum proceeds will rise to 5.60 yuan, keeping the developers' cut at 70 percent of the proceeds. The price of $3.99 apps will go up from 25 yuan to 28 yuan, while $1.99, $2.99 and $4.99 apps will remain at 12 yuan, 18 yuan and 30 yuan, respectively.

A number of European countries will experience price changes too. The base price has been shifted from 0.89 of a euro ($1.15) to 0.99.

Apple started accepting Chinese yuan for App Store transactions in November 2011, pricing 99 cent apps at 6 yuan. At current exchange rates, 6 yuan is approximately equal to 98 cents, a cent less than Apple's 99 cent minimum app price.

There's been no word from Apple as to when the new prices will go into effect, but some Chinese have already started voicing their concerns on Sina Weibo, China's version of Twitter. "Golden Knife Expert" said the new pricing tiers are indicative of the outlook for the US dollar.

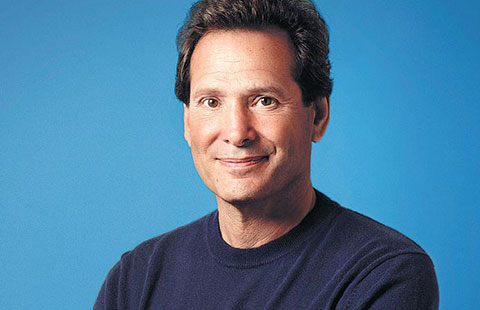

"Typical Apple users already pay a premium for Apple hardware so they are not likely to mind a small increase in the app price," said Andy Tsay, department chair for operations management and information systems at the Leavey School of Business at Santa Clara University in the heart of Silicon Valley in the US.

"I don't think the new standard will affect my purchasing activity because the best quality apps are priced way higher than the minimum price," said Xin Yue, a college graduate who is looking for a job in Shanghai. "Most of the apps I bought were around 20 yuan."

One reason the effect of this new price increase might be limited is that many apps are moving toward a "freemium" pricing model, where the app itself is free, but users pay for special features or services, Tsay said.

"This is becoming popular with games," he added. "In terms of app sales in China, games are king."

According to research from App Annie, a marketing intelligence company, gaming accounted for 90 percent of first-quarter revenue in China for apps downloaded to devices running some version of Apple Inc's iOS operating system - the highest percentage of any country served by Apple's App Store.

Apple's new pricing tiers should be good news for its game developers, assuming higher prices will bring more earnings. But some developers said that is not the case.

"Apple Stores make the global distribution channel quite easy and it is well-developed in Western countries," said Heaven Wu, overseas marketing director for Hong Kong-based mobile-game company iFree Studio.

Most very successful games in China are still those games that are free to play, he said. "So you need to change the monetization model for the game."

According to mobile app services company Flurry, China has overtaken the US to become the world's top country for active Android and iOS smartphones and tablets in 2013, a year after the country became the fastest growing smart device market in the world.

Tsay said this sector represents a very attractive market opportunity. For many of these customers the smartphone will be the primary computing device.

But as with most other product categories, Tsay said success in the Chinese market requires a deep understanding of how Chinese customers differ from those elsewhere.

"This may favor certain revenue models, such as freemium, which, if deployed properly, are resistant to piracy and can give users ways to spend money where and when they are willing to spend," he said.