Financial industry in the spotlight

Editor's Note:

This is our second forum reviewing the economy's first-half performance (the first appeared on Friday, July 5). In this edition, our focus is the state of the financial industry.

Every now and then, China is troubled by its economic and business leaders' propensity for grandiose achievements, which often result in costly and wasteful projects, and collectively, a demand for capital beyond the level the economy can supply.

With reform and opening up, although the government can still lead the economy's investment activity by its fiscal strategy, and manage the overall money supply through the central bank, it doesn't mean China can avoid all the troubles leading to a financial crisis as seen everywhere else in the modern world.

China has already seen its total debt rise to an unprecedented level.

New financial instruments, especially off-balance-sheet accounts and transactions, can cause disasters if they are made to serve the propensity for grandiose achievement without discreet coordination and regulation on the central level.

Indeed, how much financial risk is China facing? How should it manage its debt and stay away from trouble? How should it continue from here to finance its growth? China Daily invited some economists to share their views.

Q1:

Does China really have a liquidity problem? If not, where has all the money gone? If yes, how serious is it? And if not, why are so many people talking about it?

Q2:

An evaluation of the overall state of health of Chinese banks. Which part of the financial industry and what kinds of financial companies are most threatened by the rising debt level and the decrease in the money supply?

Q3:

What moves can the government make to help the financial industry control its risks? How should the government deal with the shadow banking business?

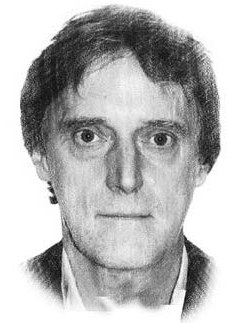

Duncan Freeman senior research fellow of the Brussels Institute of Contemporary China Studies