'Now is time to invest in mobile games'

|

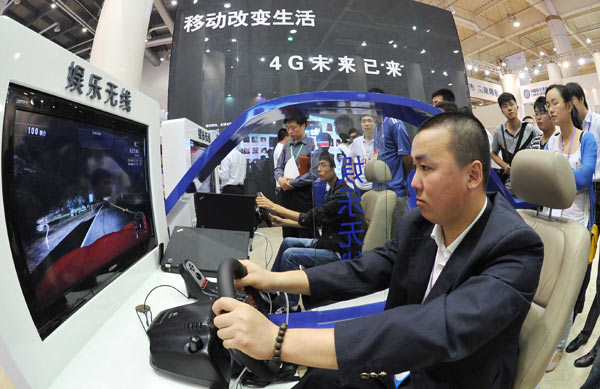

Mobile games now account for 7.5 percent of the country's gaming industry, with sales amounting to 2.53 billion yuan ($412 million) in the first half, according to the China Gaming Industry Report released on Wednesday. [Photo / Provided to China Daily]

|

The mobile games industry is undergoing massive expansion in China but investors have yet to recognize the huge potential for profits and its need for investment, said analysts.

"It seems we have waited long enough and reached the moment when the sago cycas tree blossoms," said Huang Shengli, managing director of China Renaissance Securities (HK) Ltd, using a Chinese idiom for a sudden and dramatic change. He was speaking at the investment and financing forum of the China Game Business Conference in Shanghai on Wednesday.

By the end of June this year, the number of mobile game users reached 171 million, up 119.3 percent year-on-year, according to the China Gaming Industry Report released at the conference. The actual sales revenue of mobile games amounted to as much as 2.53 billion yuan ($412 million) in the first half of this year, up 100.8 percent year-on-year.

The usage rate of mobile Internet games rose 34.8 percent in the first six months of the year. The growth of games-on-the-go was the fastest in the computer gaming industry thanks to the prevalence of smartphones and the fragmentation of users' time, the report said.

The market share of mobile games rose for a fifth consecutive year from 5.1 percent in 2012 to the current 7.5 percent. The growth rate of the mobile games market is overtaking all the other markets, the report said.

Wang Feng, chairman and chief executive officer of the Beijing-based LineKong Entertainment Technology Co Ltd, said about two-thirds of his company's sales revenue now comes from mobile games. Six research and development teams were transferred to mobile games at the end of last year, with just one team remaining in R&D for personal computer games.

"Undoubtedly competition among mobile games companies will be more intense than that among personal computer games companies. It is impossible for mobile games companies to make a success of a mobile game as well as profits within three months," he said.

Questioned whether the mobile games industry is reaching a bottleneck in terms of distribution and the large number of copycat content, Wang predicted that a large number of small and medium-sized companies will not survive the year.

Mobile games are in dire need of financing because many investors have yet to notice the great opportunities in them, according to Tim Merel, founder and managing director of the investment company Digi-Capital, adding that now is the time to invest in mobile games, otherwise the boat will be missed.

The global sales revenue of mobile and online games reached $31 billion last year, making up 50 percent of the total sales revenue of all computer games. With the wider industry deeply disrupted by the advance in mobile Internet technology, Merel expects the number will reach $48 billion in three years, accounting for two-thirds of the market volume.

He also predicted China will take the lead in terms of the development of mobile and online games given the strengths Chinese companies have.

Wen Tianli, managing director and head of equity research at China Renaissance, said Chinese companies are mostly undervalued in the market despite the fact "the growth of the games industry is rapid, erupting and requires a large amount of cash". Chinese companies usually have a shorter life cycle and a more intense need for income.

"Apart from personal computer games, other games in the market are experiencing little growth. These companies have attached more importance to distribution channels and less to research and development," said Wen.