FDI quickens in July as economy steadies

Gain reflects investors' confidence in China, says Ministry of Commerce

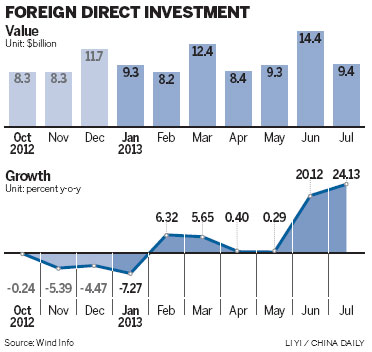

Foreign direct investment in China remained on an upward track for a sixth month in July, adding to evidence of stabilization in the world's second-largest economy.

FDI inflows were up 24.1 percent year-on-year to $9.41 billion in July, the largest expansion since March 2011, according to the Ministry of Commerce.

The figure doesn't include incoming investments in the banking, securities and insurance sectors.

"What's more important, FDI gains in June and July were in line with a pickup in momentum since February, which truly reflected that global investors are confident in China. That's particularly true of the service sector, with its major contribution to the FDI growth," Shen Danyang, ministry spokesman, told a news briefing on Friday in Beijing.

He added that the surges also reflected investors moving large amounts of money into big-ticket projects in June and July, as well as low base amounts last year.

"It's not definite that FDI will keep up this pace in the following months this year," Shen said.

In June, FDI rose 20.1 percent, the fastest rate in more than two years, to just under $14.4 billion.

In the first seven months of this year, FDI inflows totaled about $71.4 billion, up 7.1 percent year-on-year.

Last year, FDI fell for the first time since 2009, declining 3.7 percent to $111.7 billion.

But signs of stabilization have emerged, and they were reinforced on Thursday with the release of the HSBC Purchasing Managers' Index, a gauge of the activity of China's vast manufacturing sector.

The PMI rose to 50.1 in August, a four-month high, from July's final reading of 47.7. A reading above 50 indicates expansion, while one below signals contraction.

Foreign trade rebounded in July, reflecting recent trade facilitation measures and an improvement in the global economy.

China on Thursday approved the Shanghai free-trade zone, which is part of Premier Li Keqiang's drive to open up the economy to sustain growth.

The zone is expected to attract companies from overseas, and some regulations covering foreign investment will be suspended in pilot FTZs, including Shanghai.

"The FDI increase shows that global investors' worries have eased" about China's slowing economic growth in the first half.

"Some investors have robust confidence in the country's economic prospects," said Lian Ping, chief economist at the Bank of Communications Ltd.

In the first seven months of this year, FDI from 10 Asian nations and regions went up 7.7 percent to $61.74 billion, including a 55.2 percent rise from South Korea and a 612.6 percent rise from Thailand.

Meanwhile, investment from the United States increased about 11.4 percent to $2.18 billion in the January-July period, and that from the European Union was up 16.7 percent to $4.64 billion.

The service sector saw a steady increase of FDI inflows in the first seven months, up 15.8 percent year-on-year to $35.64 billion, accounting for 49.9 percent of total FDI inflows during the period.

FDI in China's manufacturing sector declined 2.4 percent year-on-year in the same period, comprising 41.2 percent of the total, according to the ministry.

"The government's move to scrap investment limits in services increased capital flows to the sector, but FDI in the manufacturing sector was not satisfactory, which was probably linked to the government's drive to upgrade industries and shift low-end ones to the central and western regions," Lian said.

FDI growth in 2013 will not be double-digit, Lian said.

However, he said, FDI for the full year will grow more than 5 percent, owing to improved investment policies, the new leadership's reforms and further opening of the services sector.

Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a government think tank, said FDI will grow "steadily" in 2013.

"China should enlarge the [list of permitted investments] in the manufacturing sector and bring new capital to high-end and strategic emerging industries, while further opening the service sector," Huo said.

In the first seven months of this year, China's overseas non-financial investment rose 20 percent year-on-year to $50.6 billion, according to the Commerce Ministry.