Aluminum producers staggering as factories lack orders

China has invested substantial sums in raw material production such as electrolytic aluminum projects, driven by global demand, but the industry faces serious excess capacity, experts said.

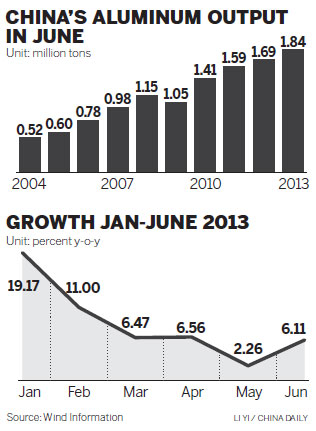

During the first half, China's nonferrous metals refining industry experienced "severe" overcapacity, rising power costs and falling aluminum prices, according to a report released by the National Development and Reform Commission, China's top planning agency, in mid-August.

It said smelting capacity was "extremely excessive", with a lack of stable resource supply. Yet the industry doesn't produce enough high value-added products, which must still be imported.

Because there's so much excess capacity, many electrolytic aluminum producers are short of orders, said Xu Yongbo, chief analyst of the metals industry at JYD Online Corp, a Beijing-based bulk commodity consultancy.

He said that many companies didn't look ahead to the possibility of shrinking demand when they started investing in the industry a few years ago. One option could be "for these producers to turn to the high-end aluminum market, which still has big potential. However, it costs too much to upgrade their production lines," he said.

In the first half, the electrolytic aluminum industry lost a combined 670 million yuan ($109 million), forcing several enterprises in central and eastern China to suspend production, according to the Ministry of Industry and Information Technology.

Based on the 12th Five-Year plan (2011-15) for the nonferrous metal industry released by the ministry, domestic electrolytic aluminum output must be capped at 24 million tons per year by the end of 2015.

But data from the China Nonferrous Metals Industry Association shows that China's electrolytic aluminum output in the past year already reached 20.3 million tons and production capacity stood at 26 million tons.

The combination of excess capacity and rising electricity prices - which account for about 45 percent of production costs - led to bitter competition and falling prices.

The sales price of electrolytic aluminum has been below production costs since August 2011.