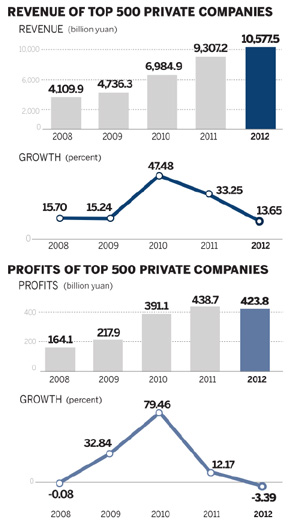

Private companies fared poorly in '12

In terms of net profit, real estate companies dominated the list, with four spots in the top 10. China Vanke Co Ltd took the top spot with a 15.6 billion yuan in net profit in 2012.

In terms of net profit, real estate companies dominated the list, with four spots in the top 10. China Vanke Co Ltd took the top spot with a 15.6 billion yuan in net profit in 2012.Talking about the pressure China's entrepreneurs face, Wang Qinmin, president of the federation, said tough conditions were providing impetus for change.

"The restructuring of the economy requires business transformation and upgrading of the corporate sector. There are a number of issues that entrepreneurs need to consider, including innovation in products, technology, brands and management," he said.

While the era of ultra-fast expansion is drawing to a close for private-sector companies, State-owned enterprises are gaining an ever larger hold on the economy.

Major SOEs have grown swiftly, even as the economy slowed. In 2010, 61 mainland companies, mostly SOEs, made it onto the Fortune 500 list, with total annual revenue of $2.89 trillion.

In 2012, however, 85 mainland companies made it, with total annual revenue of $4.69 trillion, up 62.5 percent. Of those 85, only eight were private companies.

When it released the 2012 list, Fortune noted that the SOEs were overwhelmingly concentrated in controlled areas such as energy, resources and banking, leaving little room for private companies.

According to the federation, 51.4 percent of private companies said that the limited progress was due to administrative barriers in regulatory agencies and 39.6 percent said the capital and technological thresholds for entering those sectors were too high.

Further, 34.6 percent said established SOEs in those sectors resisted their entry.

Wang said that Premier Li Keqiang has read the federation's survey of the private sector. Li said that he was well aware of the difficulties and the existence of "invisible thresholds" for private investors' entry into certain sectors, Wang said.

Liu Ying, an economics professor at Tsinghua University, said the slower growth of the private sector was mainly caused by the weak broader economy in China and overseas.