China is a major contributor to global growth

China was the second-biggest contributor to global wealth growth last year as domestic households got richer amid rapid economic growth, said a report released by Credit Suisse AG on Wednesday.

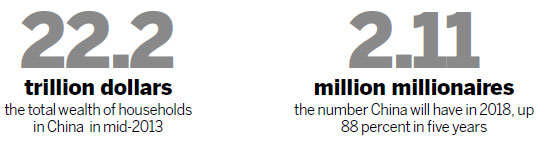

The total wealth of households in China increased 6.7 percent, or $1.4 trillion, to $22.2 trillion from mid-2012 to mid-2013. The country is second only to the United States, which saw total household wealth rise 12.7 percent, or $8.1 trillion, to $72 trillion over the same period. Overall, global household wealth increased 4.9 percent, or $11.3 trillion, to $241 trillion.

China's expected economic growth slowdown will be gradual and won't stall the growth of household wealth, said Fan Cheuk Wan, Credit Suisse's chief investment officer for Asia Pacific. By 2018, China will be home to 2.11 million millionaires, up 88 percent from 1.12 million in 2013. At the moment, China has 5,831 ultra-high net worth individuals, who have assets over $50 million each, accounting for 5.9 percent of the world's total. Almost half of the world's ultra-high net worth individuals are in the US.

The report, which covered 216 countries and regions with 7.15 billion in total population, defines net worth or wealth as the value of financial assets plus real assets and minus household debt.

"China will continue to be a major engine for global household wealth growth in coming years," said Fan at a news conference in Hong Kong.

She added that China has a high level of mobility. The country saw a sharp rise in the number of billionaires from two in 2005 to 64 in 2010, reflecting high upward structural wealth mobility. In Japan, for instance, the number of billionaires shrank considerably over the past decade. Also, Japan was the only nation in Asia that saw its total household wealth decrease last year.

In a separate report issued on Wednesday, German insurer Allianz SE said that China's wealth per capita ranks only 38th worldwide, averaging 4,720 euros ($6,406). China now has 413 million people in the middle class, and was the biggest contributor to middle class growth in the word last year, the report said.

Allianz also said that the rapid credit growth in China is ringing alarms. The growth of debt in the country is faster than that of assets, meaning that the country is getting increasingly leveraged, and a high-leveraged economy has a bigger chance of crashing if asset prices go down.