Manufacturing under lingering pressure

By Chen Jia (China Daily) Updated: 2014-04-02 08:33

|

Li Yi / China Daily |

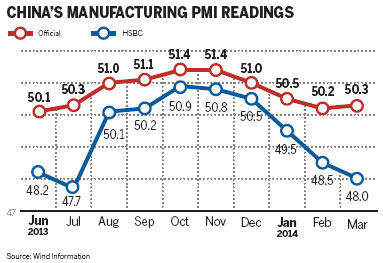

The official rise went against the HSBC Holding Plc's manufacturing PMI, which sampled small and medium-sized enterprises.

On Tuesday, the HSBC PMI showed a more pessimistic picture in March. The figure slipped to 48 from 48.5 in February, indicating that business conditions in the manufacturing sector deteriorated for the third consecutive month.

|

|

|

One factor behind the slowdown is the government's anti-pollution campaign, which has shut down numerous small steel and cement mills, he said, adding that rising labor costs also squeezed many small businesses.

Qu Hongbin, chief economist in China and the joint head of Asian economic research at HSBC, said the figure confirmed the weakness of domestic demand conditions. "This implies that the first quarter GDP growth is likely to have fallen below the annual growth target of 7.5 percent."

It may lead to a fine-tuning policy soon to stabilize growth, he said.

Premier Li Keqiang said last week when he visited Northeast China's Liaoning province that the government has policies ready to counter any volatility this year, as well as the capability to maintain growth within a "reasonable range", - that is, a GDP growth rate around 7.5 percent this year.

A report from the Bank of Communications Co Ltd lowered its first quarter GDP prediction to 7.3 percent from 7.6 percent, as both domestic and external demand shrank quickly against the last three months of 2013.

Poor export figures, slowing fixed-asset investment and weak industrial production will add to pressure on the economy, said Lian Ping, chief economist at the bank. "If there is no fine-tuning policy to support growth in the short term, it is uncertain we will see a rebound in the second quarter."

He said that in March the year-on-year growth rate of industrial output may have accelerated to 9 percent from 8.6 percent during January and February, adding fixed-asset investment was likely to have increased by 18.5 percent from January to March, compared with 17.9 percent in the first two months of the year.

Xinhua contributed to this story.

- COFCO to buy Noble agribusiness

- New paradigm of China-EU partnerships

- China, EU target annual students interflow at 300,000 by 2020

- China to start feasibility study on China-EU FTA

- Robot industry gets down to nuts and bolts

- Wenzhou's bad loan ratio growing, but at a slower pace

- Rise in Japan sales tax may hit China exporters

- Business jets exhibited at China's luxury lifestyle show