Looking at the bigger picture

By Zhou Junsheng (China Daily) Updated: 2014-04-17 07:13Despite pressure from economic downturn, the government will show greater tolerance unless it threatens to cross the bottom line

In a keynote speech delivered at the opening ceremony of the Forum for Asia Annual Conference 2014 on April 10, Premier Li Keqiang said China will not adopt short-term stimulus policies to address what are temporary economic fluctuations; instead it will focus on the sustainable and healthy development of the economy in the middle and long run.

|

|

Under such a central government policy tone, the local governments of Guangdong, Hainan, Jiangxi and Guizhou provinces and Tianjin municipality published their lists of key projects for the year, which represent a total investment of 7.13 trillion yuan ($1.14 trillion). Such colossal investment plans, coupled with some major infrastructure construction projects due to be unveiled by major enterprises, have caused concerns about a new round of stimulus packages, such as the ones the country launched in the wake of the 2008 global financial crisis, and fuelled market expectations for stimulus policies from the central government, such as the support of fiscal funds, investment expansion, a preferential taxation policy, as well as lowering banks' deposit reserve ratio and interest rates.

Over the past decade, the country has frequently turned to temporary stimulation measures to spur the economy, which has successfully guaranteed an economic growth above the expected level. The 4-trillion-yuan investment program launched by the central government at the height of the global financial crisis in 2008 effectively helped curb the spread of the contagious crisis to China and prevented its economy from suffering a severe recession. However, such an investment spree also produced obvious negative side effects, such as further increasing China's dependence on administrative regulations for economic growth and crippling to some extent the normal function of the market. At the same time, the sprawling investment campaign under an expansionist monetary policy caused excessive exploitation of resources and the environment and triggered serious inflation.

- Models at New York auto show

- China's economy will not see hard landing

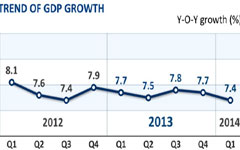

- Economic growth in Q1 drops to 7.4%

- Air China's in-flight Web access put to test

- How urbanization can help the poor

- Disney-Shanghai partnership portends a creative boost

- Chinese economy resilient enough to refute worries

- China's FDI inflow down 1.47% in March