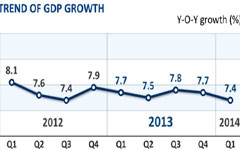

Growth on slow track for rest of year: EIU

By Li Jiabao (China Daily) Updated: 2014-04-24 07:20Numbers like that have renewed concerns about an economic hard landing.

"Although China's slowdown is a cause for concern, investors, in our view, are guilty of at least some overreaction. The government has made no secret of its desire to clamp down on credit-fueled growth, which has created overcapacity in China's economy, leading to rising levels of debt and signs of stress among its banks," said a press release from the group.

|

|

"Even if disruptions occur in the external environment, China has enough tools to ensure short-term development," Liu said.

She added that China's real estate sector, on the whole, isn't in a bubble and that its prospects are promising in the long term.

Export conditions are "quite optimistic" for this year, with estimated annual growth of 9 percent.

Fan Jianping, chief economist at the State Information Center, disagreed with Liu and said that second-half GDP growth will outstrip the first half, with full-year growth of about 7.5 percent.

"Analysts were somewhat too pessimistic about China's economic growth at the beginning of this year. They didn't notice the structural changes. The share of the service sector in China's economy has surpassed that of the manufacturing sector, and the growth rate of the service sector is also faster," Fan said.

He added that economic growth will gain momentum in the second half as the government's support measures will boost investment and the recent renminbi depreciation will encourage exports.

- Chip maker targets China's middle class

- Monopoly break-up to shore up economy

- Chinese lawmakers worried over energy efficiency, emissions

- China's land registration to help regulate home market

- China's Yingli eyes French PV market

- Foxconn wages new kind of ‘war’

- Behind-the-scenes-look at Facebook

- PKU Resource Group looking for mascots