WH Group to chop IPO in HK

By Emma Dai in Hong Kong (China Daily) Updated: 2014-04-24 07:20According to the China Securities Journal, sources within the group said on Tuesday that the IPO will be postponed until the middle of May.

Under the adjusted conditions, the company may sell new shares equivalent to 10 percent of its enlarged capital. No old stock will be offered. The share price will still range from HK$8 to HK$11.25.

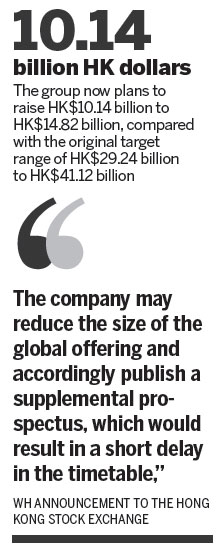

Under the new plan, the group is to raise HK$10.14 billion to HK$14.82 billion, compared with the original target range of HK$29.24 billion to HK$41.12 billion.

Under the new plan, the group is to raise HK$10.14 billion to HK$14.82 billion, compared with the original target range of HK$29.24 billion to HK$41.12 billion.

The IPO proceeds are intended to cover debt the company took on to buy Smithfield Foods Inc, the largest pork processor and exporter in the United States. The deal was completed in September.

WH Group plans to use about $4 billion from the net proceeds to repay syndicated loans due on Aug 30, 2016, and Aug 30, 2018, it said in an announcement last week.

Steve Wang, chief China economist of Reorient Financial Markets Ltd, said the key to the IPO is pricing and size. "WH Group has a good story, but demand is weak. Market sentiment is rather lukewarm at this moment.

"We expected it to be priced at the lower limit," Wang said.

Although China's economy grew 7.4 percent in the first quarter, which was "not bad", Wang said investors, especially international ones, are unsure about the country's economic prospects. "It's all very confusing," he said.

"Data such as housing numbers show polarized trends in the market. Investors are concerned. They may be interested in WH Group, but they also want to watch its performance after the IPO."

Wang said WH had appointed too many sponsors and bookrunners.

"Too many people are sharing the pie. That means they have to keep the offer price at a certain level to cover the fees. Coordinating different banks is a delicate task."