Incentive for rural finance

(China Daily) Updated: 2014-04-24 07:00The cut in the reserve requirement ratio for rural financial institutions is a small step to facilitate the flow of credit in China's rural areas.

However, to narrow the country's huge urban-rural development gap, more such financial support is badly needed to upgrade the rural economy and raise farmers' incomes.

On Tuesday, the central bank announced a 2-percentage-point cut in the reserve requirement ratio for rural commercial banks and a 0.5-percentage-point cut for rural cooperative unions beginning Friday.

|

|

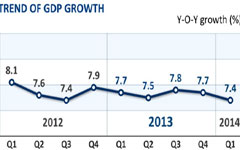

Yet such a targeted boost for rural finance should neither be the harbinger of an overall relaxation of monetary and fiscal policies to stop the economic slowdown nor a temporary move to bolster rural development.

The unexpected slump in trade so far this year and the signs of a cooling property market have definitely added to the difficulties Chinese policymakers face in rebalancing the economy at relatively lower growth rates.

The strong growth in exports has served as both a cause and a result of China's rise as a leading manufacturing power in the past three decades, while the property boom has contributed significantly to economic expansion and the growth in revenue enjoyed by many local governments in recent years.

But since urbanization and domestic consumption will be the driving forces for the country's future long-term growth, policymakers should not backpedal on the macroeconomic control that is necessary to cut overcapacity and accelerate industrial restructuring.

It is reassuring that the central bank was quick to point out that the latest decision will not affect the overall liquidity in the banking system, indicating no need for sweeping changes to the country's prudent monetary policies.

The country's financial sector has long been dominated by State banks, which have understandably focused their businesses on profitable clients in major cities. However, the government has vowed to boost financial services for farmers, agriculture and the rural areas, so it can be expected that the targeted credit policy will be further expanded to tilt the financial sector so it meets the numerous and growing financing needs in rural areas.

- Chip maker targets China's middle class

- Monopoly break-up to shore up economy

- Chinese lawmakers worried over energy efficiency, emissions

- China's land registration to help regulate home market

- China's Yingli eyes French PV market

- Foxconn wages new kind of ‘war’

- Behind-the-scenes-look at Facebook

- PKU Resource Group looking for mascots