Chinese private firms tap into overseas markets

(Xinhua) Updated: 2014-04-26 16:20BEIJING - More Chinese private companies are pinning their hopes on overseas markets as they search for profits.

Shanghai Fosun Pharmaceutical (Group) Co Ltd, a private drug maker, is involved in a bidding war for American healthcare company Chindex and has raised its offer, Fosun announced on its website this week.

In February, Fosun and private equity firm TPG made an offer for Chindex, which runs the United Family Healthcare chain in China, the country's first foreign-invested hospital.

Liang Xinjun, CEO of Fosun, said in a country with a growing and aging population, the healthcare industry is expected to boom. Considering overburdened public hospitals and increased competition, the acquisition would help the company increase access to the market.

"Now it might be the best time for Chinese enterprises to seek mergers and acquisitions (M&A) overseas," Liang said.

Chinese private enterprises have been involved in a wave of overseas M&A in real estate, food and other areas in recent years.

Property developer Dalian Wanda Group acquired America-based cinema operator AMC in 2012. Last year, China's largest meat processing enterprise Shuanghui International announced the acquisition of Smithfield, the largest Chinese takeover of a US company.

After developing in China for nearly 20 years, Greenland Holding Group is now seeking real estate projects in European and American cities.

Fosun clinches two European deals in 24 hours

Fosun cooks up deal for Malaysian eatery chain

Fosun, Prudential get cozier on investment

- Fosun Pharmaceutical acquires Israeli aesthetic device company

- Fosun buys 20% stake in Taiwan pastry maker

- Wanda sets sights on hotel expansion overseas

- Wanda Group has big plans for 2014

- Wanda steers yacht maker to its home shores

- Wanda Cinema Line partners with Coca-Cola China

- Wanda chief tops rich list with $14 billion

- Online loan search engines boom

- Bank loans to small Chinese firms rise

- China Life's Q1 profit nosedives

- Agricultural Bank of China's Q1 profits up

- Shanghai auto show plans major changes

- Sean Clarke named as head of Wal-Mart's China operations

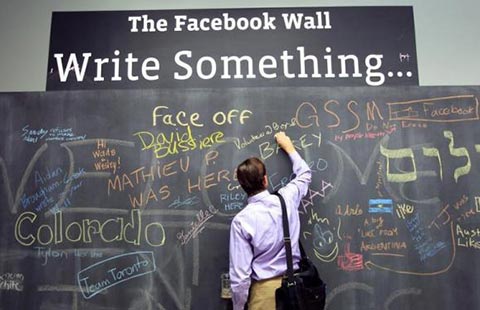

- Study: Consumers wary of brands' official websites

- CSRC sets IPO disclosures deadline