Factors of various hues take gloss out of mall cosmetics

By Xie Yu in Shanghai (China Daily) Updated: 2014-05-06 11:33But analysts said the shrinking shopping mall sales are related more to rising online sales and the expansion of other channels.

"I do not think political reasons are the major factor affecting the cosmetic industry," said Ma Shuai, a researcher with China Market Monitor, a market intelligence firm based in Beijing. "In fact, online sales of cosmetics have been going up in recent years. Door-to-door sales of companies such as Amway and beauty stores like Sephora are nibbling away at market share for traditional shopping malls.

"I do not think political reasons are the major factor affecting the cosmetic industry," said Ma Shuai, a researcher with China Market Monitor, a market intelligence firm based in Beijing. "In fact, online sales of cosmetics have been going up in recent years. Door-to-door sales of companies such as Amway and beauty stores like Sephora are nibbling away at market share for traditional shopping malls.

"The cosmetics industry will keep sustainable growth in coming years," he predicted, "but with fiercer competition among the various sales channels."

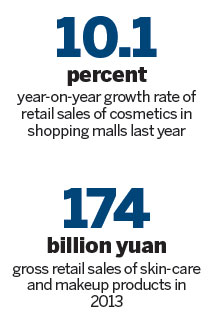

Gross retail sales of skin-care and makeup products reached 174 billion yuan in 2013, according to CMM. Shopping malls remain the biggest sales channel and occupied 34.9 percent of the total sales. Sales revenue for e-commerce platforms, beauty stores, supermarkets and door-to-door selling accounted for 25 percent, 12.8 percent, 17.8 percent and 7.5 percent, respectively.

As for specific cosmetic brands, foreign brands are still the mainstream in China's cosmetics market, with the top three belonging to L 'Oreal, Olay and Mary Kay, which collectively make up 12.45 percent of retail sales, according to information provider Companies and Markets.

As disposable incomes continue to rise, more sales growth is expected to happen in lower-tier cities, Ma said.

|

|

| Revlon kisses China goodbye | L'Oreal expands factory, bets on future in China |

- Building virtual bridges in South African markets

- New organization formed to boost China's EV industry

- Poor Chinese residents see rapid income growth

- Chinese entrepreneurs seek business contacts in Poland

- HSBC manufacturing PMI sluggish in April

- Ministry: Trade in services a key priority this year

- Shanghai unifies urban and rural pension plans

- Finance firms now profitable business in China