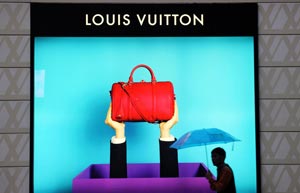

China enters new luxury market era

By Karl Wilson in Sydney (China Daily) Updated: 2014-05-12 08:12"Local property barons are now building half the world's new shopping malls in China, many of them in smaller cities, because even punters without big incomes are becoming big shoppers," it added.

For luxury brands, China has been a natural magnet over the last decade or more, especially as home markets in Europe and North America haemorrhaged in the wake of the global financial crisis.

|

Bruno Lannes, a partner with management consulting firm Bain & Co, says he expects China's luxury market to grow at around 2 percent this year.

"(And that is) much the same as last year," Lannes told China Daily, who is also Bain & Co's head of consumer goods and retail practice in Greater China.

He says growth last year was around 2 percent compared with 7 percent in 2012.

"The government's policy on frugality and anti-gifting has impacted on the sector, especially watches and menswear," he says.

Another factor is the growing number of Chinese who are now buying many of their luxury goods overseas. China's tax and tariff policy makes most luxury brands more expensive.

Bloomberg recently said, "Many of these travelers buy Western or designer goods abroad because import duties and other taxes add up to 60 percent of their prices in China, compared with cities like London, Paris or Hong Kong."

Lannes says overseas purchases by Chinese last year grew by 67 percent.

According to Bain & Co's latest survey on China's luxury market, Chinese travelers now account for 29 percent of global luxury spending. "Chinese consumers, especially women, are becoming more sophisticated and informed about brands," Lannes says.

Nick Debnam, Asia-Pacific chairman for consumer markets with KPMG China, says China is experiencing a slowdown in the luxury market but is not going backwards or in decline. "True, you are not seeing the 20 to 30 percent annual growth rates in luxury sales you saw a few years back."

|

|

| Luxury cars make Asia premiere at Auto China |

- Top 10 favorite luxury brands of Chinese women

- Luxury cars make Asia premiere at Auto China

- 25% of China's luxury car owners are women

- Luxury hotel mogul amazed by Shanghai resorts

- Chinese luxury shoppers flocking online: survey

- Chinese tourists to drive luxury products market

- China world's biggest luxury consumer

- 'You have to be there to build the brand'

- Senior officials urge fixing excess financial innovations

- Struggle to meet new-energy goals

- Mass marriage: Alibaba and the 102 couples

- Explosion of riches

- China enters new luxury market era

- Inventor looks to generate waves of interest

- China's chain store giants see slow growth