Tech, nickel shares lead tumble

By Bloomberg (China Daily) Updated: 2014-05-16 07:14

|

|

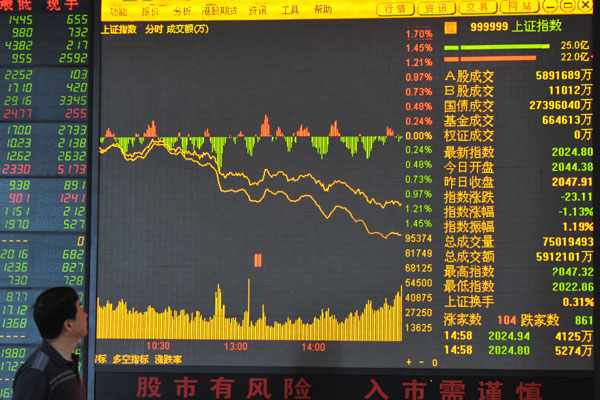

China's stocks fell on Thursday, sending the benchmark index to its biggest loss in two weeks, on concerns that a slowdown in Asia's largest economy will hurt earnings. Lu Qijian / For China Daily |

China's stocks fell on Thursday, sending the benchmark index to its biggest loss in two weeks, on concerns that a slowdown in Asia's largest economy will hurt earnings.

Anhui USTC iFlytek Co sank 5.1 percent, leading technology shares lower. Yanzhou Coal Mining Co, the fourth-biggest Chinese coal miner, paced losses by commodity producers. Jilin Ji En Nickel Industry Co fell 5.8 percent as nickel slumped.

The Shanghai Composite Index slid 1.1 percent to 2,024.97 points at the close, the deepest decline since April 28.

|

Data on industrial output, retail sales and investment released this week all trailed analysts' estimates. President Xi Jinping said last week that China needs to adapt to a "new normal" in its pace of economic growth.

"The recent data confirm the fact that the economy isn't in good shape," said Dai Ming, a money manager at Hengsheng Hongding Asset Management Co in Shanghai, which oversees about $193 million. "There's no reason that investors can find to justify buying stocks."

The CSI 300 Index slid 1.3 percent to 2,144.08, while the Hang Seng China Enterprises Index dropped 0.5 percent. The Bloomberg China-US 55 Index, a measure of the most-traded US-listed Chinese companies, slipped 0.2 percent Wednesday.

The Shanghai measure has lost 4.3 percent this year on concerns that the growth slowdown will curb earnings and that the potential resumption of initial public offerings will divert funds.

The regulator hasn't approved any listing of new shares since January as it reforms the process to make offerings more market-oriented.

- Fringe telecom players entering the fray

- High-tech park growing local innovation

- Cool heads needed in viewing China's economy

- China, 'world's factory', lacks skilled workforce

- Protecting environment tops public concerns in poll

- Licenses revoked in anti-porn campaign

- Mobile Internet business booming in China

- New day dawns for labor rights in Pearl River Delta