Nonperforming loans may eclipse the level of 2008

By Jiang Xueqing (China Daily) Updated: 2014-05-16 10:48Analysts say soft economy, higher reserves will eat into banks' profits

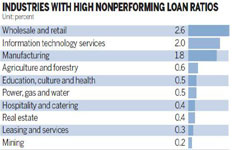

Chinese banks' bad loans hit their highest point since September 2008 amid the pressure of an economic downturn, and they will continue to rise, making it likely that more low-end, export-oriented manufacturing companies in Jiangsu and Zhejiang provinces will default this year than in 2008, financial experts said.

|

|

|

That represents a rise of 54.1 billion yuan from the beginning of the year.

The banks' NPL ratio increased by 0.04 percentage point to 1.04 percent during the same period, said the China Banking Regulatory Commission in an online statement published on Thursday.

The continued slowdown of the economy will make the rise in bad loans unavoidable, said Li Wei, an analyst in the banking sector at China Galaxy Securities.

However, he emphasized that the financial risks are still "controllable".

"The risks are more likely to be exposed slowly rather than having a sudden outbreak," Li said.

"It takes time for China's industrial restructuring to make a positive impact on its economic growth.

In about two years, when economic reform takes effect, the banks will have better control of their nonperforming loans," he said.

Currently, the rise in bad loans has forced banks to set aside more provisions against risk.

That trend is further, cutting into their profits.

- Chinese enterprises' investment in Britain surges

- China to promote innovative securities businesses

- China collects more taxes Jan-April

- Fringe telecom players entering the fray

- High-tech park growing local innovation

- Cool heads needed in viewing China's economy

- China, 'world's factory', lacks skilled workforce

- Protecting environment tops public concerns in poll