HK bourse to sell RMB products

By Emma Dai in Hong Kong (China Daily) Updated: 2014-05-23 07:02"When a two-way street is created and new products are developed, certainly Hong Kong will embrace a more active offshore renminbi market," Yu said.

"It's important to have access to China's interbank bond market, where 90 percent of bond market liquidity is concentrated," said Jack Wang, managing director and head of the institutional client group at CSOP Asset Management Ltd. "Currently, overseas investors can tap the market through the renminbi qualified foreign institutional investor program.

|

|

The QFII program allows foreign investors to use offshore foreign currency to trade in mainland equities. The RQFII program allows similar investors to use offshore yuan for the same purpose.

"However, I am also amazed by how little some other investors know about RQFII - even major hedge funds. There are a lot of RQFII products available. Investors really need to try them to tap the opportunities that come with China's opening up."

Separately, analysts said that the market for dim sum bonds (yuan-denominated bonds issued outside of the mainland), though popular among international investors, needs more depth.

"On the one hand, we have accumulating liquidity - not only in Hong Kong but also Taiwan and Singapore. On the other hand, there is a scarce supply of yuan-denominated investment instruments. That creates problems in the secondary dim sum bond market. People just buy and hold because of the availability issue," said Frances Cheung, head of rate strategy of Credit Agricole CIB.

She added that while demand for dim sum bonds is high in general, there is little supply in the medium-term segment of the market, which covers five- to 10-year maturities.

"To fill the gap, we need some issuers to have that incentive to issue five-year bonds. Outside Asia, there are some United States and European companies that have direct investments in China that may need medium-term money to fund their projects in China."

- PBOC announces rules for accounts in Shanghai's FTZ

- Shares of JD.com soar 17% in market debut

- Get them while they're hot

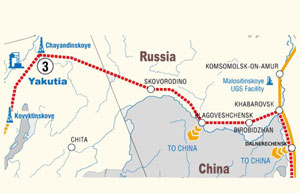

- China-Russia energy deals

- Foreign tech firms to face tougher times

- Top 10 most popular cities for migrants

- Gas deal with Russia offers longer-term security

- A wedding planner's day