The multibillion-dollar house that Jack built

By Meng Jing (China Daily) Updated: 2014-05-25 23:22"He always has high expectations of his team. And, like a good coach, he lets you know it when he is unhappy with your results, because he always expects 100 percent effort. Rather than having employees try to please him as a boss, he aligns the staff to chase a more important goal, such as building a platform which creates millions of jobs," he says, adding that when he left Alibaba in 2008, he felt that it was on its way to becoming a world-class company because it had survived some of the Internet's leaner times and survived a big battle with the e-commerce giant eBay.

|

|

|

|

Like e-Bay, Alibaba's platforms, for a long time, were free to customers. As a start-up company at the time, it needed to find investors.

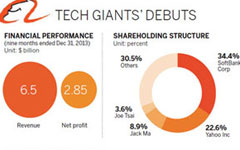

So Ma brought in investment from SoftBank Corp in 2000 and Yahoo in 2005. In the following years Alibaba and Yahoo had rows that were eventually patched up.

Alibaba's strong business performance has become a key driver for Yahoo's share price. The $20 million that the SoftBank founder Masayoshi Son invested in Alibaba in 2000 is expected to make him one of the richest people in the world as SoftBank is Alibaba's largest shareholder with a 34.4 percent stake.

With the huge pile of money Alibaba is expected to raise from the IPO, the top question for Jack Ma is what is next for Alibaba. Michael Clendenin, managing director of RedTech Advisors LLC, a Shanghai-based IT consultancy, says Alibaba's IPO is unusual.

Jack Ma stepped down as chief executive officer in May last year, saying he was no longer young enough to run an Internet business, but he still serves as chairman of the board.

He is reported to write e-mails to Alibaba staff to encourage them in their work. In the first four months of this year, Alibaba Group and Ma invested a combined 37 billion yuan in various companies ranging from traditional media and video to department store operator, becoming one of the most aggressive investors among China's big three Internet giants, the other two being Tencent Holdings Ltd and Baidu Inc.

Vanessa Zeng, an analyst with Forrester Research in Beijing, says: "With frequent investments, such as its acquisition of AutoNavi and its strategic investment on Intime Retail Group Co and online video site Youku Tudou Inc, Alibaba has been trying to build a complete ecosystem that can compete with these competitors. "The challenge will lie in effectively integrating the properties it has newly acquired and invested in," Zeng says.

Ma has said in an intra-company email that Alibaba faces "unparalleled challenges and pressures" in the US IPO because of the scale, expectations, cultural clash and consciousness of national boundaries, geopolitics and economics.

Going public is not an end in itself, he says, but a way of ensuring the company keeps on advancing.

- Standard Chartered offshore RMB index rises slightly in July

- Shanghai-HK stock link to speed up capital market reforms: Barclays

- Relaxing restrictions on foreign investments

- Fujian on course to help create the new maritime Silk Road

- Foreign investors set sights on new targets

- UK looks to diversify in China

- Malaysia keen to expand trade ties

- HK still top choice for mainland firms