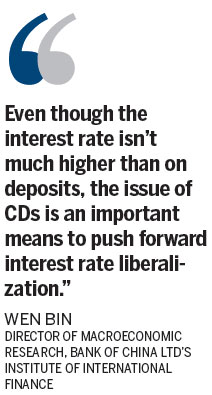

CD liberalization 'a step forward'

By Jiang Xueqing (China Daily) Updated: 2014-05-27 07:12For some large depositors, the interest rate of 3.4 percent on one-year CDs is more attractive than the maximum fixed-term deposit rate of 3.3 percent with the same maturity, so the difference will help the banks attract a steady flow of large deposits.

But financial experts said that the rate is still far from competitive in the current domestic money market.

"Compared with various wealth management products, the CDs could only attract clients with a very low risk tolerance," said Mu Hua, a banking analyst at GF Securities Co Ltd.

The seven-day annualized yield of Yu'ebao, an investment product offered through Alibaba Group Holding Ltd's online payment affiliate Alipay, was 4.83 percent on Sunday.

Even commercial banks offer an average annualized return of about 4.3 percent on wealth management products, which offer preservation of capital.

"But in the long run, certificates of deposit may attract more clients if China launches a deposit insurance system, as the system will cover CDs, not wealth management products," Mu said.

The central bank is trying to reduce the impact of CD issues on commercial banks by targeting the product at high-end clients. The minimum investment will keep a large number of depositors from shifting their money from deposits into CDs, according to Wen.

- COSL's oil exploration enters second phase

- Top executives held on corruption charges

- Shaanxi savors 'Silk Road' potential

- Britain eyes China's green construction market

- China seeks bigger sway in gold trade

- Pillow fight to relieve the stress of mortgage

- China's bank card issuance at 4.39b

- China's logistics growth further slows