Executives are 'still positive' on outlook

By Wei Tian in Shanghai (China Daily) Updated: 2014-06-04 06:58"A large number of well-educated workers, research and development capabilities accumulated over the years and a big consumer market fueled by increasing affluence and urbanization indicate the potential of China," said Chng.

The low-cost fundamentals that reshaped China's economy are beginning to evolve, spurred by rapid wage increases, rising transportation costs and currency appreciation. Those trends have driven efforts to increase the share of consumption in the economy, he said.

|

|

Amid those efforts, many foreign companies are moving to serve local demand. They're shifting attention and investment to inland provinces, which now absorb 17 percent of FDI.

For example, US-based Wal-Mart Stores Inc plans to open 110 new stores and make changes to cater to the country's growing population of urban consumers. And Japan-based Toyota Motor Corp's joint venture - Sichuan FAW Toyota Motor Co - is expanding production in Chengdu to meet growing domestic demand.

Asked when their investment levels would return to pre-2008 crisis levels, nearly half of those responding to the Kearney survey said that would happen by 2015. More than one-third said it's already happened.

Given the estimate by JPMorgan Chase & Co that large companies globally are sitting on $5.3 trillion in cash, "we can conclude there is ample room for additional investment that can help jump-start the global economy", according to the report.

Chinese government figures show that last year, FDI in the Chinese mainland increased 5.25 percent to $117.59 billion.

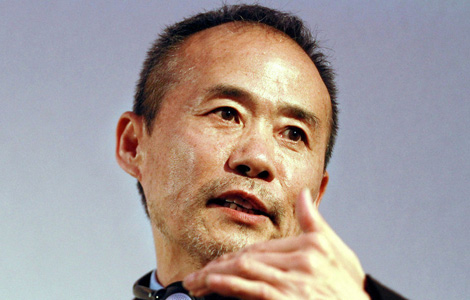

Zhou Mi, a researcher with the Chinese Academy of International Trade and Economic Cooperation, a think tank at the Ministry of Commerce, said China has always held an open attitude toward foreign investment, but policies should be "more mature and regulated" in the future, taking account of national security and antitrust issues.

The ministry announced last Friday a three-month pilot program to simplify approval procedures for foreign investment, with the goal of encouraging overseas investment as economic growth slows.

Wang Tao, chief China economist with UBS AG, said the world's second-largest economy should experience a modest recovery this summer, the result of several small stimulus moves to revive growth.

|

|

- Tycoons at UK-China Business Leaders Summit

- Leading digital ad firm to expand in Chengdu

- Asia's largest ICT show kicks off in Taipei

- Top 10 most expensive properties in Beijing

- New star emerging in global media market

- Kazakh students say Silk Road will create more jobs

- Shanghai drugstores begin sales of baby formula

- China and Kuwait sign energy agreements