Investors to seek bridge over troubled waters

By Zheng Yangpeng (China Daily) Updated: 2014-06-04 06:58

US officials and experts claim that China is preoccupied by the failure of a few high-profile cases.

"CFIUS is not nearly the problem that some people think," Baucus said. "I know that politically, sometimes it's used. But we have to cut through the politics and get down to the economics, and I can tell you it is not an issue."

He repeated the assurance made previously by many US officials that most foreign investments do not go to CFIUS, and those that do represent only a very small percentage of all cases.

Mark Plotkin, partner with law firm Covington & Burling LLP, said foreign companies take a controlling stake in approximately 1,500 US companies a year. Of those, around 150 are reviewed by CFIUS, with only a few being rejected.

US officials stressed that its infrastructure sector promises abundant opportunities, and they welcome China's participation, whether through financial investment or providing goods and services.

A report commissioned by USCC and completed by Covington and other firms, said at least $8 trillion in new investment will likely be needed in US transportation, energy and wastewater, and drinking water infrastructure from 2013 through 2030, totaling some $455 billion a year.

Energy represents the largest opportunity at $4.64 trillion, or 57 percent of the total, followed by transportation (36 percent) and water (7 percent).

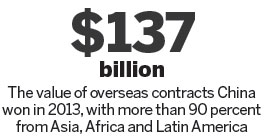

But so far, Chinese investment in these sectors has been quite limited, despite the fact that Chinese engineering and construction companies have prevailed in Asia, Africa and Latin America. Of the $137 billion in overseas contracts China got in 2013, more than 90 percent were from Asia, Africa, Latin America, while less than 1 percent was from the US, according to data from the Ministry of Commerce Ministry.

There are good reasons for that. Aside from the unfriendly environment perceived by Chinese companies, they are - particularly in the engineering sector - hampered by quality concerns, specific procurement requirements and after-sale issues.

The report by USCC estimated that China's participation as a vendor is "primarily cost-based". That means that when quality concerns outweigh price concerns, Chinese firms are less likely to get a deal.

|

|

|

| Businesses more active in Beijing Fair | CIFTIS kicks off in Beijing |

- Racing to a new prosperity

- China tops UN-sponsored list for renewable energy industry

- Nikon recalls cameras over battery dangers

- South East Motor in recall over gear faults

- Tycoons at UK-China Business Leaders Summit

- Leading digital ad firm to expand in Chengdu

- Asia's largest ICT show kicks off in Taipei

- Investors to seek bridge over troubled waters