Yellow metal loses sheen as global economic risks recede

By Wu Yiyao in Shanghai (China Daily) Updated: 2014-06-04 06:58The price of gold slid 3.8 percent in May, the biggest monthly loss so far this year, as hedging demand contracted amid stabilizing global economic conditions.

|

|

Gold futures at the New York Commodity Exchange closed at $1,246 per ounce for August delivery last Friday, the final trading day of May. That was the lowest close since February.

In China, prices at the Shanghai Futures Exchange and Shanghai Gold Exchange also slumped to their lowest since February.

Analysts said the trend wasn't surprising, since the use of gold and silver to hedge risk has declined compared with recent years, when investors were more worried about economic prospects and global security concerns.

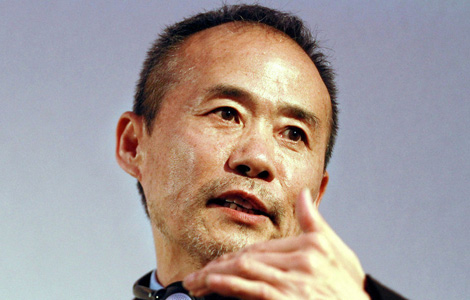

Growth in Europe and the United States appears to be recovering, and concern over tensions between Russia and Ukraine are fading. As a result, capital may flow out of the gold market into other assets that offer higher yields, said Yang Fei, an analyst at Shanghai Seewonder Financial Information Technology Co Ltd.

"Gold is by nature a risk-hedging tool and an asset class, and holding gold, either physical or futures, can still be a reasonable part of a portfolio," said Yang.

The price of physical gold in Beijing dropped from 385 yuan ($62.35) per gram in April 2013 to 316 yuan per gram in April 2014, a decline of about 18 percent, according to Caishikou Department Store, a precious metal trading hub in Beijing.

However, consumption of gold, especially for ornamental purposes, is still strong in China, thanks to the country's passion for the precious metal and its symbolic and emotional meaning. Fleeting losses may have little impact on gold holders in China, said market insiders and analysts.

Gold in China has a cultural meaning beyond that of a mere metal. It also represents a family's wealth that can be handed down through the generations, and in this sense, buyers of physical gold don't worry much about short-term price fluctuations, according to Xue Ke, chief analyst and deputy general manager with Tianjin Jinhengfeng Precious Metals Management Co.

|

|

|

| Did Chinese dama lose big on gold? | Dama dames: China's secret weapon |

- Training seminar to aid industrial transferring into Africa

- Pingtan pilot zone releases negative list

- Mobile health initiative set to take off in China

- Taste Austrian chocolate in Shanghai

- China welcomes US greenhouse gas plan

- US abuses trade remedy measures: MOC

- China dissatisfied with US plan to slap high duties

- China all set to grow as 'megatrader'