Fiscal policy to play larger growth role

By ZHENG YANGPENG (China Daily) Updated: 2014-07-03 07:30

The cut applied to two-thirds of city commercial banks, 80 percent of rural commercial banks below the county level and 90 percent of cooperative banks below the county level, according to the People's Bank of China.

Zhou said the banks that are eligible for the ratio cut could extend into more joint-stock banks.

The central bank last week also revised the way loan-to-deposit ratios are calculated to give banks more capacity to lend. BOC said the calculation could be further adjusted within certain sectors to encourage lending to "strategically emerging industries".

|

|

|

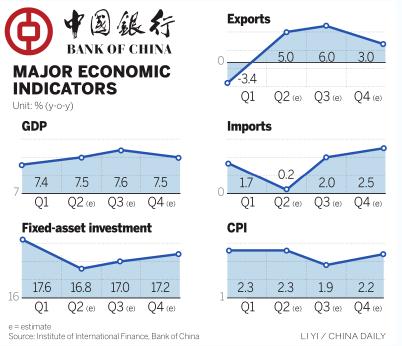

It estimated 7.5 percent GDP growth for the second quarter.

Looking ahead, it forecast 7.6 percent for the third quarter and 7.5 percent for the whole year.

China will release second-quarter GDP figures on July 16. Institutions' projections range from 7.3 percent to 7.5 percent.

Property cooldown not fatal to GDP

The property sector is important to China's economy, but perhaps not as important as some might think.

A study by the Institute of International Finance under Bank of China Ltd noted that since 2009, the sector's contribution to GDP has steadily declined.

Since China privatized its urban property sector in 1998, its contribution to GDP has gone from 4.2 percent in 1999 to 16.4 percent in 2009.

But the ratio has declined since 2010, when the central government took measures to cool the market and rein in soaring prices. Its contribution to GDP that year fell to 10.6 percent and in 2012 to 9.3 percent, but it rebounded in 2013 to 10.7 percent due to an extraordinary boom that year.

The study predicted that China's property investment will rise by 15 percent this year, but the sector will drag down GDP growth by only 0.33 percentage point, a figure that shouldn't scare the public.

Even in the gloomiest projection, showing property investment growth sinking to 10 percent, GDP would be dragged down by only 0.62 percentage point.

But this scenario is unlikely to occur, the report said, because the government has ample capacity to cushion a slowdown-for example, by building more government-subsidized housing and rolling out more projects backed by budgeted funds.

- Architectural marvel or fumble: weird buildings in China

- China to strengthen media cooperation along Silk Road Economic Belt

- Fourth Peugeot-Dongfeng China plant gets green light

- State Council wants innovation-driven growth, tourism development

- Chinese yuan exchange rate in equilibrium: report

- Housing sales fall 36% in Shanghai

- China's rural areas outpace cities in online shopping

- Tianjin to boost trade ties with Taiwan