Leading from the front lines

By Du Juan (China Daily) Updated: 2014-07-04 08:43

Han said Fu's "go west" strategy, propelled by the Unocal move, laid the foundation for CNOOC's successful acquisition of Canadian energy giant Nexen Inc in 2013.

"The one thing that stands out about Fu is his innovative spirit. He is someone who keeps his cards to himself and his actions are often unpredictable," said Han.

The biggest development for the energy sector in China this year was the news that government plans to end the State-owned companies' domination of the industry by allowing more private participation.

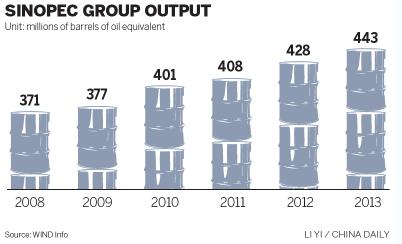

In February, Sinopec said it was planning to sell up to 30 percent of its retail businesses to private investors, a move hailed by industry experts. This and several other forward-looking measures adopted by Fu have made him one of the key persons driving the industry fortunes in China.

"Selling the retail unit is the first step in Sinopec's planned reforms. We have an integrated and comprehensive plan for further reforms," said Fu. "We want to make the board fully market-based," he said.

Dispelling doubts on whether private investors would gain equal rights in decision-making after they are part of Sinopec's retail business, Fu said reforms are not just gestures, but concrete steps to protect the interests of all shareholders.

Han said that Sinopec's reform measures are sensible as it is not profitable for the company to operate service stations in the long run. "The retail unit can bring significant profits and it is innovative and beneficial to bring in more participants," said Han.

"Fu likes challenges and he has brought a whiff of fresh air (new thinking) to Sinopec, something that is a rarity in a State-owned company," he said.

|

|

| Report: Energy costs to hit $5.7t | CNOOC, BP sign 20-year LNG supply deal |

- China's printing market becomes world's second largest

- China, S. Korea vow to finish FTA talks before end of 2014

- Weaving profits, tradition with hand-made dresses

- S.Korea, China agree to launch Won-Yuan trading market in Seoul

- Battery venture gets conditional approval

- Baosteel set to take control of Aquila

- Leading from the front lines

- Yuan takes another major step toward full convertibility