Capital account risks 'can be managed'

By Yang Ziman (China Daily) Updated: 2014-08-05 07:19China has recognized the irresistible force of capital account liberalization.

The Development Research Center of the State Council has stated: "Macroeconomic measures such as monetary and fiscal policies will be used to adjust the market instead of direct government intervention."

Last year, many preparatory steps were taken. In July, the People's Bank of China, the central bank, removed the loan rate floor. And in August, the China (Shanghai) Pilot Free Trade Zone was established as a testing ground for financial reform.

Since the yuan can be exchanged freely in the zone, it can lead to exchange arbitrage.

"The key is to push on with financial reform," said Sekine. "Financial agencies must fulfill their role. If the reform of the banking system is not effectively carried out, rich people will transfer their assets overseas. Concrete steps must be taken in establishing bankruptcy procedures for banks, the liberalization of interest rates and an increase of direct financing. Also, the government should speed up reform in the China (Shanghai) Pilot Free Trade Zone and expand it to other regions to prevent exchange arbitrage."

To minimize the risks, capital account liberalization should start with capital inflows and proceed to capital outflows. It should also prioritize direct, long-term, legal person and foreign currency-dominated investment before further opening up to securities, short-term, individual and yuan-dominated investment, Sekine said.

Cheung said that China is still in the process of liberalizing its interest rates and exchange rates before opening the capital account.

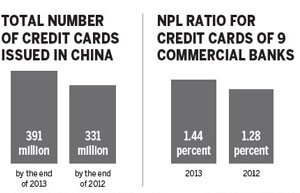

"The government needs to ensure that the financial system can handle sudden and large capital outflows, especially given that China's debt-to-GDP ratio is rising and there are potential large nonperforming loans in the system.

"Banks will need to ensure that their assets and liabilities are properly matched ahead of any sudden exchange rate movements."

As for the reform experiments in Shanghai, Cheung worries that too much reliance is being placed on the zone.

"The area is too small to make dramatic changes in the country," he said. "But it can serve as an example or catalyst. The Shanghai free trade zone's use of the 'negative list' appears to be gaining traction around the country, and it's a good example of best practices being spread."

James Lee, regional director of greater China at the Institute of Chartered Accountants in England and Wales, said that Shanghai will be at the forefront to benefit from free capital flows once the capital account is fully liberalized.

"Once capital controls are loosened, then Shanghai can set up its international (equities) board," he said.

"It will have strong global companies that will list on the Shanghai Securities Exchange, giving Chinese investors more opportunities to invest. Locally listed Chinese companies will have to improve their transparency so that the investing public can make good comparisons. This will also move money away from the housing market and stabilize the housing bubble."

|

|

|

|

|

- Supply-chain management is a must for manufacturers

- Capital account risks 'can be managed'

- Food scandal hurt McDonald's results

- Western regions to enhance links with train system

- CAAC, Rolls-Royce extend training

- P&G drops weaker brands to focus on core product gains

- Car dealership rules take new direction

- China orders factory safety overhaul