Crude prices retreat on downbeat China data

(Xinhua) Updated: 2014-08-23 11:09NEW YORK - Crude prices retreated Friday amid discouraging Chinese manufacturing data of August.

The economic calendar is light Friday, traders digested the data released during this week. China's manufacturing sector slipped to 50.3 in August, down from 51.7 in July, the lowest for three weeks, the banking group HSBC said Thursday.

Oil prices also dropped as traders took profit of the previous day's gains. Prices gained Thursday after a string of solid economic data of the United States made market expect stronger crude demand from the top global energy consumer.

Crude prices stepped back as the US is approaching the end of peak driving season, which runs through Labor Day, Sept. 1 this year.

The closely watched Janet Yellen's speech was largely in line with expectations. The Federal Reserve Chair said slack remains in the labor market even after gains made during the five years of economic recovery.

Light, sweet crude for October delivery moved down 31 cents to settle at $93.65 a barrel on the New York Mercantile Exchange, while Brent crude for October delivery lost 34 cents to close at $102.29 a barrel.

|

|

|

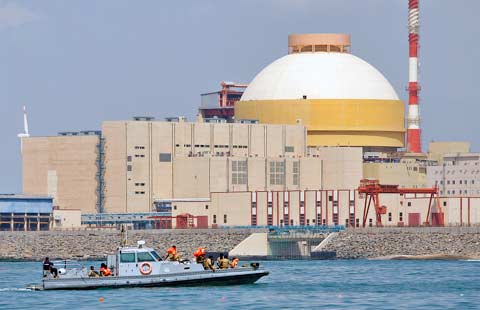

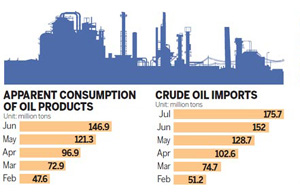

| Manufacturing gauge triggers fresh concerns on 2014 growth | China's demand for overseas crude to expand this year |

- After food safety scares, China retailer offers baby milk insurance

- IBM confident on growth in China business

- Top 10 Chinese cities with best business environment

- New private fund regulation puts the focus on risk tolerance

- Export demand lifts Delta firms' prospects

- Anti-monopoly actions unlikely to affect Swiss companies

- Sinopec, Yhd ink branding deal

- Donglian's shift from coal to travel pays off