What the world is saying about Alibaba's IPO

By Dai Tian (chinadaily.com.cn) Updated: 2014-09-10 16:37Alibaba's impending IPO is one of the most talked-about stories in the world. Here is a selection of quotes from international and Chinese media.

|

| Jack Ma, chairman of China's largest e-commerce firm Alibaba Group, attends a corporate event at the company's headquarters on the outskirts of Hangzhou, Zhejiang province in this April 23, 2013 file photo. [Photo / Agencies] |

As its IPO nears, Alibaba gets ready for a splashy debut

-New York Times, on Sep 5

"So, the largest US IPO is now a Chinese company. It's a sign of things to come as Chinese firms that have huge scale gained from their massive domestic market 'go global'."

Alibaba - set to be the largest US IPO in history

-BBC, on Sep 6

The firm dominates online shopping in China, which has passed America to become the world's biggest e-commerce market. In terms of gross sales, Alibaba is bigger than eBay and Amazon combined… There were worries, as there had been about Facebook, that Alibaba might stumble in the transition from desktop computers to mobile devices.

After the float

-Economist, on Sep 6

"Several pre-IPO shareholders are cashing out portions of their stakes, reflecting the maturity of Alibaba, which was founded in 1999. However, the planned sales represent relatively small portions of early investors' stakes, indicating that those investors hope to remain on board with the company longer term."

Alibaba targets $155 billion value in IPO

-Wall Street Journal, on Sep 5

After the IPO, Alibaba will have billions of extra cash on hand. The company is likely to use some of those funds to shake up American commerce and Silicon Valley… Listing in the US also affords the company an opportunity to introduce itself to American consumers.

How Alibaba could change American business

-CNN, on May 7

"Some outsiders describe Alibaba's culture as cult-like, prizing crazy antics and fanatical loyalty to Mr. Ma. However, most former employees who agreed to speak to the FT said there was method to the madness.

…Employees are constantly evaluated by managers on their commitment to six core values: teamwork, integrity, "customer first", "embrace change", commitment and passion."

Method in the madness of the Alibaba cult

-Financial Times, on Sep 7

"It's up to companies to decide where to get listed. Alibaba's listing application in the US is believed to be out of a rational choice, and show the openness of Chinese market.

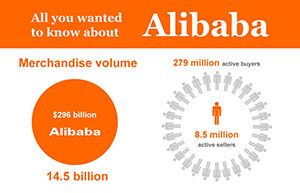

Though faced with many difficulties, internet companies travel overseas to get listed, exposing the embarrassment for Chinese capital market. It's quite common for companies to seek IPOs in their home markets where most of their business operate. Alibaba has 231 million active buyers and 8 million active sellers in China. But once listed in the US, the company will contribute most of its profits to American investors."

Why wouldn't Alibaba seek listing in its home market?

-People's Daily, May 8

- Security risks found in half of China's government websites

- Microsoft to launch Xbox One in China

- China's first Hermes Maison opening in Shanghai

- China opens gold market to foreigners

- Financial reforms top Li's agenda in Shanghai

- 11 Japanese firms fined for antitrust violation

- Alibaba in talks with Snapdeal to enter India: Economic Times

- 7 Chinese cities that still restrict home buying