Homebuyers go online to finance down payments

By Bloomberg (China Daily) Updated: 2014-11-06 09:52"The pressure on the borrowers to repay the down payment in a year together with the mortgage is fairly high," said Bei Fu, S&P's Hong Kong-based property analyst. If this becomes a trend, "investors will be bearing the brunt of the default risks when the market or economy makes a negative turn".

Low down payment lending to subprime borrowers, those with poor credit and limited cash, also contributed to the surge in foreclosures in the US.

"The less of the homeowner's own money is put into the payment, the more likely he or she will default" when asset prices plunge, Zhang said. "The risk is brewing slowly."

In China, most of those who borrow for down payments have money invested elsewhere, according to E-House Deputy Chief Financial Officer Ma Weijie. Buyers who want to buy a home and do not have the money often turn to relatives or take out consumer loans from banks to use as deposits, a practice the banking regulator has banned, Zhang said.

It caps lending for deposits at 15 percent of the price of a buyer's first home and 20 percent for second properties, and it only lends to owner-occupiers.

The company collects a 1 percent fee from borrowers, Ma said. Developers who want to boost sales subsidize the interest payments to investors and provide guarantees or deposits to E-House against potential defaults by the borrowers.

China Overseas Land & Investment Ltd and Poly Real Estate Group Co are among the 22 builders that have signed up with E-House to provide the service at some of their projects, Ma said.

Online property lending may rise to 20 billion yuan this year and possibly grow to about 1.2 trillion yuan a year assuming 15 percent of home sales are financed by P2P investors, said Ma.

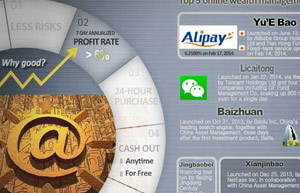

P2P lending has taken off in China since 2011 as traditional methods of private lending among family and acquaintances, part of the country's unregulated $6 trillion shadow banking system, move online.

Investors through P2P websites have helped drive a 50-fold increase in online financing to 64.6 billion yuan as of Sept 30, for anything from weddings to personal medical expenses, according to wangdaizhijia.com, which tracks more than 1,000 of these little-supervised sites in China. The country has no regulations governing Internet finance.

Shenzhen World Union Properties Consultancy Inc, based in the southern city that borders Hong Kong, granted 551 million yuan in similar loans through a micro-credit unit in the first half of this year, after introducing the service in July 2013 for clients who did not have a down payment.

Shenzhen World Union charges interest of more than 20 percent on some of its loans. Financial services income jumped 139 percent in the first half, driven mostly by 60 million yuan from the loan service, according to company filings.

The trend gained momentum in September when Ping An Insurance (Group) Co, the nation's second-largest insurer, began offering loans to buyers of 121 residential projects developed by Shimao Group and Greenland Group at interest rates as low as zero.

|

|

| P2P sites are clicking with borrowers | Shanghai leads effort to rein in housing market |

- China welcomes Indonesia to join AIIB

- Developers' bonds wilt as issuers' finances weaken

- Three Gorges project generates 800b kWh electricity

- China's phone users reach 1.5b

- Measures will keep local debt burdens in check

- China Southern launches Guangzhou-Jeju Island service

- Homebuyers go online to finance down payments

- Changan Ford commissions 3rd China plant