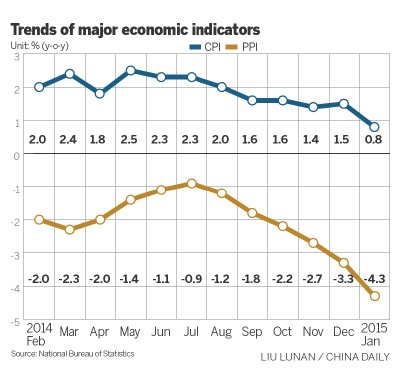

Inflation rate dips to 5-year low in January

By Chen Jia (China Daily) Updated: 2015-02-11 07:21

"These data help explain last week's decision by the People's Bank of China to cut reserve requirement ratios, which was a helpful but likely insufficient policy move," said Song Yu, an economist at Goldman Sachs Group Inc. "We expect further easing, with a benchmark rate cut likely before the end of the first quarter."

The central bank cut the amount of cash that all banks must set aside as reserves by 50 basis points, which was the first broad cut since May 2012.

JPMorgan Chase & Co lowered its CPI prediction for this year to 1 percent from 1.5 percent.

Zhu Haibin, chief economist in China at JPMorgan, said that the government will likely speed up pricing reform for utilities such as natural gas, electricity and water, as well as transportation, to help offset the imported disinflationary pressures of lower oil prices.

"Further softness in the inflation trend points to rising levels of real interest rates, which tend to intensify the pain of economic adjustment amid sluggish domestic demand and high levels of domestic leverage. As such, combining the concerns about near-term growth and the low inflation environment and PPI deflation will likely trigger further pro-growth measures," said Zhu.

Deflation has become the real risk for the Chinese economy, and this concern may prompt the central bank to further ease monetary policy, said Liu Ligang, chief economist in China at Australia and New Zealand Banking Group Ltd.

To ease the deflation risk and curb huge capital outflows, Liu forecast that the PBOC is likely to cut the deposit interest rate by 25 basis points in the first quarter of this year.

Liu said there may also be another 50 bps cut in the reserve ratios in the second quarter.

- China to show its IT power in CeBIT 2015

- Patent dispute threatens Xiaomi's India future

- Joint 5G standards to be set

- Chinese premier sees innovation countering slowdown

- Interest rate cut more likely

- Cheaper scheme launched for imported cars

- China's outstanding social financing up 14.3% in 2014

- China should be alert to deflation risks