Risks rise for Chinese companies' overseas M&As

By Li Xiang (China Daily) Updated: 2015-02-12 07:27Among the 120 failed outbound deals between 2005 and 2014, about 25 percent were due to political reasons, a recent report showed.

Though China became a net capital exporter last year with total outbound direct investment reaching a record $102.9 billion, a majority of the deals were loss-making, some experts said.

Xu Hongcai, an economist at the China Center for International Economic Exchanges, said: "Lack of talent familiar with international practices has also been a major shortcoming for Chinese companies in overseas markets."

Related stories:

Top 10 outbound M&A deals by Chinese companies 2014 by Sun Chengdong, chinadaily.com.cn

Chinese companies grew increasingly active in overseas deal-making activity last year, according to data from Thomson Reuters.

The value of announced mergers & acquisitions (M&A) involving Chinese companies soared to record highs and amounted to $396.2 billion so far this year, a 44.0 percent increase compared to last year.

China's overseas acquisitions in Europe grew 90.8 percent to $17.7 billion compared to last year ($9.3 billion). This is the highest deal value since 2008 driven by State Grid International Development Ltd's pending acquisition of a 35 percent stake in CDP Reti Srl.

This marks the strongest-ever annual period for China-involvement announced M&A since records began in 1982.

Here are the top 10 outbound M&A deals involving Chinese companies in 2014.

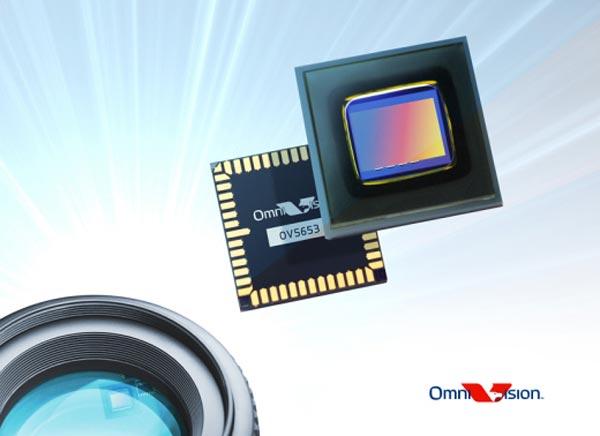

No 10 Hua Capital Management Ltd and Shanghai Pudong Science & Technology Investment Co Ltd, acquired OmniVision Technologies Inc, a US digital imaging device manufacturer.

Deal value: $1.22 billion

|

|

|

The digital imaging chips made by Omivsion. [File photo] |

- Russian dual-screen YotaPhone places big bet on China

- Baidu revenue falls short of estimates as customers go mobile

- China's machinery trade surplus hits record

- Tianjin's 'green city' plans taking shape

- CICC may raise $1b from stock offering in Hong Kong

- Investors shifting focus in global realty purchases

- Divergence key theme of property market

- Dalian Wanda expands Atletico brand