Creation of private lenders to be accelerated

By Jiang Xueqing and Meng Jing (China Daily) Updated: 2015-03-10 07:44

China will accelerate the creation of privately owned commercial banks this year, according to a top banking regulation official.

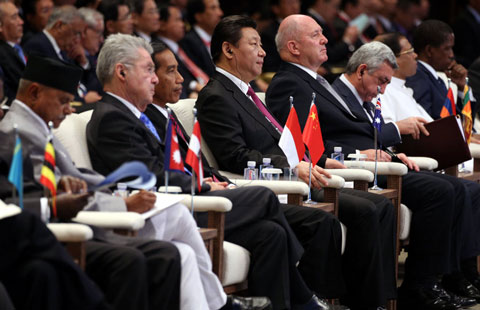

Guo Ligen, vice-chairman of the China Banking Regulatory Commission, told China Daily on Saturday the banking regulator will offer more licenses for private banks this year.

Speaking at a group discussion with members of the National Committee of the Chinese People's Political Consultative Conference, Guo noted that Premier Li Keqiang said on Thursday in the annual Government Work Report that there is no quota for private investors to establish small and medium-sized banks and financial institutions.

"That sends a strong signal," Guo said. "The number of banking licenses to be issued by the CBRC will depend on the number of applications to launch private banks."

The commission has received more than 20 applications and given the green light to the creation of five private banks.

Liao Min, director-general of the CBRC's Shanghai office, said only a few private banks were approved last year because some other Asian countries and regions had had bad experience of private banking at the beginning of the sector's development.

"These family-owned commercial banks had insider-trading problems due to their shortcomings in corporate governance. We want to learn from these lessons and we are very prudent in how we launch the program," he said.

Earlier this year, Huarui Bank, the first private bank in Shanghai, started operation on a trial basis.

"I don't care about how profitable a private bank might be," Liao said. "The most important thing on my radar is its corporate governance and business strategies."

Registered in the China (Shanghai) Pilot Free Trade Zone, Huarui is targeting FTZ-related business, such as cross-border and overseas funding for small and medium-sized enterprises and high-tech companies.

Liao said he is looking forward to Huarui providing a sustainable competitive business model for other new privately owned commercial banks in the country.

"Private banks are entering the market as China faces economic downturn. Commercial banks are suffering from profit decline and financial disintermediation.

"To become successful, private banks must find sustainable and competitive advantages of their own," he said, adding that China needs all kinds of financial services but the current system cannot provide them.

Market insiders say private banks are in great demand because of the difficulties and high costs involved in financing for small and micro-sized enterprises.

Chen Zhilie, a member of the CPPCC National Committee and head of the technical equipment chamber under the All-China Federation of Industry and Commerce, said the chamber plans to apply to create a private bank this year to help provide financial support to technical equipment firms.

- Israel requests to join Asian Infrastructure Investment Bank

- Chinese stocks rebound on April 1

- China, the West in Africa: more room for cooperation than competition

- Nanjing cuts taxi franchise fees

- Air China increases flights to Milan, Paris

- JD.com raises delivery charges

- Veteran corporate strategist upbeat about China economy

- L'Oreal China sales revenue up 7.7% in 2014