China's prudent monetary policy to continue

By Jiang Xueqing (China Daily) Updated: 2015-03-13 08:51Flexible approach may be used as economic conditions warrant, central bank head says

|

|

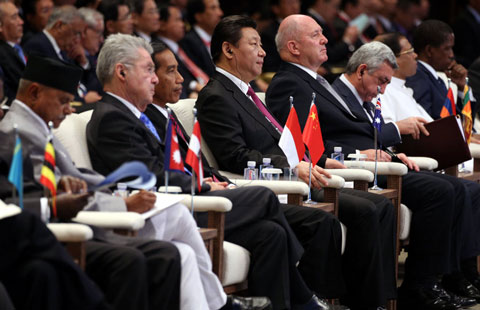

Zhou Xiaochuan, governor of People's Bank of China, takes questions from journalists at home and abroad during an ongoing press conference on March 12, 2015. [Wei Xiaohao / chinadaily.com.cn] |

China will not change its prudent monetary policy stance, but would consider adopting a more flexible approach by tilting it toward either a tighter or more easing direction, a top central bank official said on Thursday.

Zhou Xiaochuan, governor of the People's Bank of China, said at a news conference during the annual meeting of the country's top legislature: "The Chinese economy is facing a 'new normal', or a new stage of slower growth than the past few years. But a new normal is still a normal situation, not something special or problematic. So we don't need a new term to define our monetary policy."

He noted that the central bank recently used a number of monetary policy tools that the public is unfamiliar with, such as the standing lending facility, but the volume of liquidity released by each tool was not very huge compared with the size of the Chinese economy.

"Although we used various monetary policy tools, the growth of broad M2 money supply is still moderate. It shows that our prudent monetary policy remains unchanged," he said.

Statistics released by the PBOC on Thursday showed that M2 rose 12.5 percent in February from a year ago, quickening from 10.8 percent in January, which was the weakest since 1998.

Chinese banks extended 1.02 trillion yuan ($162.9 billion) of new loans in February, well above market expectations. For the first two months combined, new lending rose to 2.49 trillion yuan, from 1.96 trillion yuan a year earlier.

Zhou said the central bank has tried to inject more capital into the areas of the economy where structural changes are mostly needed and it will take some time to see an increasingly positive effect of such policies. But he also said the public should not overestimate the impact of liquidity management and base money issuance on the adjustment of economic structure.

Qian Yingyi, dean of the School of Economics and Management at Tsinghua University, told China Daily there is no need for the central bank to ease its monetary policy unless new problems arise in the economy.

"People think monetary policy can work magic in stimulating the economy. But the monetary policy should not play this kind of role. What is more important is the overall economic restructuring, for which the monetary policy can provide a stable environment," said Qian who is also a member of the National Committee of the Chinese People's Political Consultative Conference.

- Israel requests to join Asian Infrastructure Investment Bank

- Chinese stocks rebound on April 1

- China, the West in Africa: more room for cooperation than competition

- Nanjing cuts taxi franchise fees

- Air China increases flights to Milan, Paris

- JD.com raises delivery charges

- Veteran corporate strategist upbeat about China economy

- L'Oreal China sales revenue up 7.7% in 2014