COSCO Piraeus bid back on track

By SHI JING (China Daily) Updated: 2015-03-31 08:12Comments by visiting official signal change in Greek government's attitude on stake sale

|

|

Greece's largest port, Piraeus, near Athens. China Ocean Shipping (Group) Co is one of the five industry players that have shown interest in a 67 percent stake in Piraeus Port Authority.[Photo/Agencies] |

Comments by a visiting Greek official indicate that the bid by China Ocean Shipping (Group) Co for the Piraeus Port Authority, which has been on hold for about two months following the country's election, could be accepted in the next few weeks.

COSCO was one of five industry players, including the United States' largest port management company Ports America Inc, to show an interest in a 67 percent stake in Piraeus Port Authority in the second half of 2014.

The future of the deal became uncertain after voting in January that put hard-left Alexis Tsipras in the prime minister's office. He quickly suspended the privatization process.

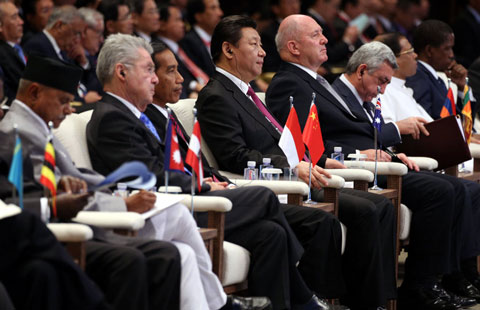

Greek Deputy Prime Minister Yannis Dragasakis, who was part of a delegation to Beijing from Wednesday to Saturday, told the official Xinhua News Agency that the privatization would be completed within weeks, with COSCO to be "an active participant" that "can make a very competitive offer".

Dragasakis said the process had been "slightly delayed" mainly because there was "a change in the public entity owning the port's shares due to the change in government in Greece".

For its part, COSCO has said that it is too early to forecast a result as there are other bidders.

Foreign Minister Wang Yi said in discussions with Greek Foreign Minister Nikos Kotzias that the two countries should cooperate more closely and make the Piraeus Port project an example of mutual benefit.

The U-turn in the Greek government's attitude may reflect the country's dire economic plight. It was due to submit a new version of its reform program-the third-to European creditors and regulators on Monday.

Unless the plan is approved by the European Commission and the nation's creditors, the Greek government will not be able to get further bailouts.

The government is facing salary and pension payments of 1.7 billion euros ($1.84 billion) due by Tuesday. It will also have to pay back a loan of 450 million euros by April 9.

- Israel requests to join Asian Infrastructure Investment Bank

- Chinese stocks rebound on April 1

- China, the West in Africa: more room for cooperation than competition

- Nanjing cuts taxi franchise fees

- Air China increases flights to Milan, Paris

- JD.com raises delivery charges

- Veteran corporate strategist upbeat about China economy

- L'Oreal China sales revenue up 7.7% in 2014