Mainland money continues to fuel stock surge in HK

By Xie Yu (China Daily) Updated: 2015-06-02 10:09"Some overseas-based, long-term fund managers have called to ask what has happened to the Hong Kong market," another analyst friend told me recently.

"It seems to me that capital from the mainland is now gobbling up stocks that have been left underweight by foreign investors."

So far mainland money has shown a clear preference for mid-and small-caps whose fortunes are closely tied to growth in the mainland.

This is very different from Hong Kong's traditional appetite for blue-chips with solid liquidity.

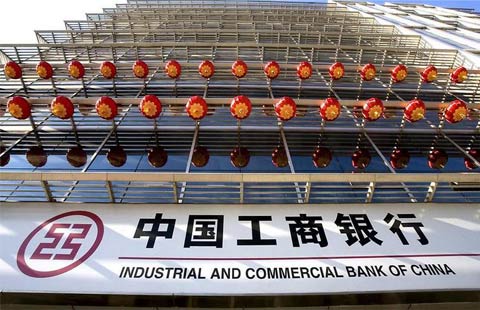

Many foreign fund houses said they remain overweight on majors, but they have started including mainland-based stocks too, often banks, within their portfolios.

As to whether I fear the bubble is likely to burst anytime soon, as veteran investors like to say, to successfully ride the Hong Kong equities train you still need a mix of courage and caution.

- Traveling the highways can fuel growth in vacation sector

- Driving into a picture postcard

- PMI up slightly in May vs April

- MAS confident of turnaround by 2018

- Aspiring e-commerce entrepreneurs must avoid being trapped in the regulatory maze

- Debt reform takes a lower priority to stabilizing growth

- FTA signed with Seoul

- Chinese wheels set to run on UK rails