|

|

|

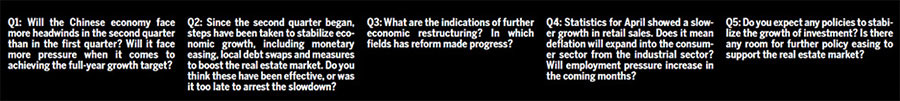

Editor's Note: After GDP growth decelerated to a six-year low of 7 percent in the first quarter, the performance of the economy in the second quarter will be crucial in determining whether the annual target of "about 7 percent" can be achieved. Despite persistent downside pressure, positive signals have emerged this year indicating progress in restructuring and reform. China Daily invited a group of economists to provide insight into the country's economy. |

|

|

|

Put plainly, the structural headwinds are just too big: Industrial performance and fixed-asset investment are still too highly correlated to policy and credit, the corporate sector is still deeply indebted, exports appear to be in for another average year, and consumption is too small a share of the economy to drive headline growth and faces its own challenges. Looking at the latest data, it is clear that the first five months of the year were underwhelming. Luckily, in terms of market sentiment, we do think that anything above 6.6 percent year-on-year growth over the next few quarters (and of course the data point around that) is broadly priced in by markets. However, below this would be a big negative for emerging markets, like South Africa, and commodity prices. The problem is that getting the "new normal" to consolidate at this rate of expansion will need some material policy support, which Beijing is doing.

So far, new lending has not been matched by commensurate new deposit growth because funds are moving out of China or going into stocks. However, if done recklessly, the supportive measures will add to the existing problems, and contradict the longer-term reform agenda embodied in the administration's November 2013 Plenum. We have not yet really seen the creative destruction necessary for altering incentives in the economy, and reshaping how land, labor and capital is allocated across the economy.

China's attempt to deal with local government finances is a case in point. Yes, converting the debt into longer-dated and cheaper debt will reduce debt-servicing costs for local authorities. However, when banks decide to buy bonds for any other reason other than the fair price of risk, then the plan goes against the idea of getting banks to embrace the market, and surely does nothing to eliminate moral hazard.

Take-home pay has been compressed over the past six months as non-wage compensation has proven ripe for cost rationalization. Then there is the anti-corruption drive, which could mean getting tougher on expense claims. This source of income is material (especially in the public sector). It is not just about gifts or bribes; it also includes institutionalized subsidies and benefits. And, this has been reduced a lot. If gray income is as much as $1 trillion (around one-fifth of total urban income) then even a 30 percent reduction adds slack in the economy and increases deflationary risks. On that note, the Consumer Price Index came in at 1.5 percent year-on-year in April, up from 1.4 percent in March, buoyed by an uptick in food prices, which was well below the 2.5 percent target. China intends to ensure that the registered urban unemployment rate stays below 4.6 percent in 2015. For now, real wages are being used as the first line of defense against unemployment, presenting a big risk for spending, but news flow suggests that layoffs are starting in distressed sectors.

Manufacturers, which accounted for one-third of total investment last year, are still battling with serious overcapacity, excess debt and lackluster demand. This is why we have seen 37 months of deflation at the factory gate. The producers simply do not have any pricing power and margins are evaporating. More time is needed to work through inventories, induce consolidation and begin deleveraging. Then, given its size and linkages to the rest of the economy, the reality is the momentum loss in investment (and the economy) cannot stop until the housing market turns around. The problem is that China's property sector is significantly overinvested, especially in third-and fourth-tier cities, which have accounted for the majority of new housing in recent years. To be fair, in terms of price, this soft underbelly of China's economy is firming up, at least in the first-and second-tier cities. The impact of a host of support measures since late 2014 has helped. Indeed, we expect home sales to see year-on-year growth in the second half of the year. However, the big impact for the overall economy is from property investment, where we simply do not expect a material rebound. |

|

China's economy is likely to bottom out in the second quarter. With policies that support steady growth put in place, pressures on the economy will be eased during the quarter. Positive elements include fast-growing infrastructure investment, e-commerce and new export momentum. Exports to countries along the New Silk Road increased by 10 percent year-on-year in the first quarter, emerging as a new highlight for exports. We expect economic growth could hover around 7 percent in the second quarter, or even reach 7.1 percent to 7.2 percent.

|

|

Five months into 2015, economic activity remains sluggish. Much of the weakness has been anticipated as it stems from a prolonged industrial and manufacturing slowdown. One factor that does stand out, however, is external demand softness. After a volatile performance due to Lunar New Year distortions, export growth in April fell by 6 percent, while imports contracted 16 percent. Year-to-date, exports grew by only 2 percent year-on-year.

Indeed, as the HSBC China Monetary Conditions Indicator showed further tightening in April, we believe further monetary easing is still urgently needed. Cumulative policy easing to date has not been sufficient and timely enough to counter the drag from the sharp appreciation of the yuan on a real effective exchange rate basis, and therefore could not lift the economy out of disinflation. To do so, more aggressive policy moves are needed, and ideally aggressive enough to reverse the expectations of financial intermediaries, who are increasingly becoming risk-averse. We are fore-casting further cuts in the required reserve ratio and interest rates. The next move will likely be a 50 basis point RRR cut in the coming weeks.

pace (than other sectors). Growth of the services sector slowed from 11.2 percent in the fourth quarter of last year to 9.6 percent in the first quarter of 2015. This is indeed much better than the primary and secondary sectors. In real terms, the services sector is still growing at a steadier pace.

We should be mindful of the deflation in the manufacturing sector, which may further restrain industrial investment and reduce employees' income. At its 12th annual meeting, the National People's Congress announced the goal of creating 10 million urban jobs in 2015. However, the labor market will likely face headwinds from slowing growth. The ratio of jobs available to job seekers dropped to 1.12 in the first quarter from 1.15 in the previous quarter, indicating weakness in the market.

|

|

Early signs on growth in the second quarter point to stabilization, albeit at a low level. Business surveys like the National Bureau of Statistics' Purchasing Managers Index edged up in May and property sales show some signs of bottoming out. If that trend is sustained, the economy should be within striking distance of the government's 7 percent target.

|

|

We expect more policy support to come, backed by an increasingly supportive Politburo policy tone. This should help take GDP growth back up to 7.1 percent year-on-year in the second quarter, but any revival will be hard to sustain as the unfolding property downturn intensifies into year-end. As such, we maintain our 2015 GDP growth forecast of 6.8 percent.

We think these measures should help mitigate against liquidity/yield distortions caused by a potentially huge release of new local government bonds to the bond market, and motivate banks to swap out old loans for lower-yielding and longer-duration local government bonds. We expect more policy support to come. Further policy support is still needed to stabilize China's growth momentum and arrest the passive tightening of monetary conditions. Policy support will deliver a modest but temporary boost to growth in the second and third quarters.

This rebalancing is due partly to China's investment slowdown and weakening global demand, and partly to fundamental structural reform. The ongoing property downturn has clearly dragged down property and industrial investment the past couple of years, whereas household income and consumption have stayed more resilient. However, China has also reduced its previous implicit subsidies in energy and utility prices; increased dividend payments by State-owned enterprises to the government; expanded pension and healthcare insurance coverage; carried out value-added-tax reform and cut taxes and fees for small businesses; and lowered entry barriers facing smaller firms and to the financial, education, culture, healthcare, tourism and other service sectors. Going forward, we see policy efforts continuing to support and extend all such trends.

Real consumption expenditure growth per capita held up at 7.3 percent year-on-year, as national average real disposable income growth held steady at around 8 percent. The resilience of China's labor market thus far has been a key contributor to this picture. Official statistics showed the surveyed unemployment rate still hovering around 5 to 5.1 percent, and 3.2 million new urban jobs were created in the first quarter, on track to meet this year's 10 million target. Data from urban labor centers suggest that there were more job postings than job seekers in the first quarter. As the property downturn unfolds through 2015, job market pressures will inevitably rise, but we nonetheless expect job losses to be less severe in scale than in 2008-2009.

Many may say China has invested too much in infrastructure after the past decade's massive construction and that its current infrastructure seems better than in most other emerging countries and even some developed economies. However, China's total capital stock per capita is still far below that of many developed economies, at only one-seventh of the United States, one-13th of Japan and one-quarter of South Korea in 2013. The central government is exploring multiple alternative ways for infrastructure investment. Central to this experiment is the so-called private-public partnership program, through which infrastructure projects with longer-term stable cash flows or reasonable commercial returns are expected to be carried out with the help of corporate balance sheets. To facilitate this process, the government is accelerating utility price and service sector reforms. In addition, cross-regional projects such as high-speed railway, national grid, giant hydraulic and hydropower projects will be funded by the central government and some central government SOEs. The government also plans to increase the role of policy banks in financing and to allow a longer transition period for local government financing vehicles to continue borrowing from their normal channels. Property policies have been eased over the past year but there is room to do more. We think the government can further cut down payment requirements, from 30 percent to 20 percent for all first mortgages, and accelerate hukou reforms in lower-tier cities later this year, if property activity weakens again. The additional rate cut we expect and further relaxation of developers' fund-raising access should also help. Existing and upcoming property policy easing will unlikely re-inflate the property bubble, and at best only mitigate and stabilize the downturn. |

|

Based on the April data and the Purchasing Managers Index for May, it seems that the economy in the second quarter will be weaker than in the first three months.

Macro indicators in the first four months were mostly short of expectations, indicating downside risks to our growth forecast of 6.7 percent year-on-year in the second quarter. The May PMI did not show any turning point. The nonmanufacturing business activity index continued to drift downward, which may indicate the service sector cannot stand alone as the manufacturing sector weakens. Reforms to further deregulate the service sector and promote urbanization are necessary to revive the nonmanufacturing sectors. Monetary policy easing will have to be accompanied by meaningful capacity cuts in the manufacturing sector to stem a growth slowdown.

The Chinese economy is facing headwinds of persistently high cost of capital, overcapacity in most of the manufacturing sectors and a property down-cycle. The government has committed to lower the cost of capital through broad-based policy easing and unconventional liquidity management of policy banks and debt swap. The economy may receive support two to three quarters after monetary easing alongside the property market stabilization possible around the fourth quarter this year.

We noticed a few reforms have made progress recently. Urbanization: Chinese authorities launched the urbanization pilot before the Lunar New Year. Urbanization should trigger relocation of consumption and investment. Assuming that the New Urbanization Plan is fulfilled by 2020, we expect: 1) Household consumption spending to increase around 10 percent or more; 2) Additional urbanization-related investment/spending may be 2.6 trillion yuan ($423.5 billion) or more each year; 3) Farmers may shift one-third to one-half of their investment in housing from rural to urban areas. Interest-rate liberalization: In early May, the deposit rate ceiling was widened from the previous 130 percent from the base to 150 percent. The central bank seems to be conveying a key message that this rate cut will also pave the way for interest rate liberalization in 2015. Capital account liberalization: Regulators agreed on mutual recognition of funds between the mainland and Hong Kong effective from July 1. We view this as a significant capital market opening-up initiative, which could accelerate the integration of the A-and H-share markets. The Shanghai-Hong Kong Stock Connect should gradually ease under-ownership by foreign investors in China's capital market. As a result, offshore investors will have access to China's growth opportunities, renminbi exposure, and more importantly, the reform premium. The Chinese leaders have initiated two key projects to mitigate concerns of geopolitics and domestic excess capacity: the Asian Infrastructure Investment Bank and the Belt and Road Initiative. This is likely to lead to a gradual process of investment out of China, in our view. The overseas direct investment-led capacity exports will likely be determined by a few factors: GDP per capita, the cost of capital in the home country, the leverage ratio of potential multinational companies, an international currency and soft power. Debt: The Ministry of Finance, the PBOC and the China Banking Regulatory Commission announced that local bonds can be used as collateral for borrowing. Meanwhile, provincial governments can issue bonds through directional distribution, which allows local governments and debtors to swap loans and other type of debts for bonds directly. The new rules were introduced to incentivize debt swaps through credit enhancement and cheap credit. The authorities want to see the first round of debt swaps by the end of August. This policy setting avoids imminent local defaults with guaranteed low-cost refinancing. State-owned enterprises: The government is taking steps to consolidate the central SOEs. Meanwhile, Guangzhou's SOE reform program proposed that mixed-ownership enterprises will become the main form of municipal enterprises. We expect an SOE reform grand plan from the central government to be the focal point in the coming quarter or so.

The nonmanufacturing PMI employment sub-index slid to the lowest level in May (47.6) since the data series began. While the job market is still diverging between unskilled and skilled labor, the risk is that, if the economy stays weak, the rising new economy including services may not be able to fully offset the job loss in traditional sectors, challenging the government's growth bottom line.

We expect the government to scale up policy easing to defend the growth bottom line. The PBOC balance sheet may expand to curtail the cost of capital and accommodate interest rate liberalization and local debt swaps. Meanwhile, the government will resolve funding constraints for infrastructure projects, foster new consumption drivers, stabilize the property sector and cut overcapacity in an orderly manner.

|