Devaluation to benefit exporters

By Zhong Nan (China Daily) Updated: 2015-08-13 07:15

|

|

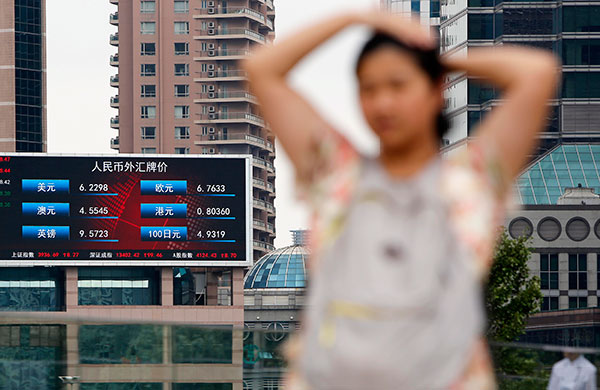

An information board showing foreign exchange rates in Shanghai. Despite the economic uncertainties associated with the devaluation of the Chinese currency, the exports sector could see a healthy uptick in the long term, a commerce ministry official said on Wednesday. [Yin Liqin / China Daily] |

Enterprises may be able to leverage on price differential for better long-term gains

Despite the gloom and economic uncertainties associated with the devaluation of the Chinese currency, the country's exports could see a healthy uptick in the long term, a top commerce ministry official said on Wednesday.

Zhang Yuzhong, deputy director of the investment promotion agency under the Ministry of Commerce, said the depreciation of the yuan will ease export pressures for domestic manufacturers. Exporters had been hit hard after the United States Federal Reserve withdrew its quantitative easing program and other nations depreciated their currency value to gain more market access, he said.

Zhang's comments came after the People's Bank of China, the country's central bank, unexpectedly lowered the currency's reference rate against the US dollar by 1.6 percent for a second consecutive day. It had lowered it by 1.9 percent on Tuesday.

"The lower currency exchange rate may curtail industrial activity in China," Zhang said. "Meanwhile, overcapacity in industries such as steel, cement, shipbuilding and photovoltaics has reduced business profitability and the demand for raw materials."

Eager to restore the earning ability for its manufacturers, China is striving to create a fair and competitive financial environment for domestic companies and looking to promote the reform of the international monetary system, as well as gain export strength in medium and high-end products with the use of technology and lift its products on the value chain.

He Jingtong, a professor of investment at Nankai University in Tianjin, said the devaluation of the yuan will benefit the country's garment, steel, shipping, chemical and automobile industries, which have suffered the most from the depreciation of the US dollar.

"The current monetary move would enable them to compete with the prices offered by other economies and stabilize exports, as well as prevent the money inflows generated from covered interest arbitrage," said He.

China's foreign trade notably dropped 7.3 percent year-on-year to 13.63 trillion yuan ($2.23 trillion) between January and July of this year. Exports decreased by 0.9 percent to 7.75 trillion yuan from the same period a year earlier, while imports slumped by 14.6 percent to 5.88 trillion yuan, data from the General Administration of Customs shows.

He said devaluing the currency and printing more money are practical steps to either promote or ensure stable economic growth over a certain period. However, if an economy does not have a solid economic foundation or strong growth momentum, it would be harmful to rely on a loosening monetary policy.

Sang Baichuan, a professor of international trade at the University of International Business and Economics in Beijing, said fast economic growth cannot reflect the right monetary policies and the government must be aware of the reality of a diminishing work force and rising labor costs. In fact, labor costs in China are no longer low from a global perspective, he said.

"Weakening price competitiveness and limited new markets indicate that it is not an easy task to boost exports in the long run," said Sang.

- 2015 China International Fair for Investment and Trade kicks off in Xiamen

- China's commodity imports robust in Jan-Aug period

- China stocks rebound 2.92%

- 2015 China box office already past 2014 total

- China foreign trade decline widens in August

- Interview: JP Morgan's senior executive bullish on China

- Innovation, development the focus for NZ mayors

- Lives of freelancers