Amazon's global approach has helped entice local shoppers

By MENG JING (China Daily) Updated: 2015-10-12 09:00The term describes Amazon China's updated cross-border online shopping service, which includes faster delivery, a better experience for customers and a greater selection of overseas products for Internet consumers. Other major e-commerce players have been quick to follow, fueled by growing demand from the country's affluent middle class.

"China will become the largest cross-border business-to-customer, or B2C, market by 2020, with the transaction volume of imported goods purchased online reaching $245 billion," a report released in June by global consulting firm Accenture and AliResearch, Alibaba Group Holding Ltd's research division, said.

With those sort of numbers, China's leading e-commerce companies Alibaba and JD.com Inc have been quick to roll out cross-border e-commerce services. Smaller Internet firms have also jumped on the bandwagon.

But Gurr is unfazed by the competition. He pointed out that Amazon runs 14 online shopping sites across the world and has the edge in cross-border e-commerce.

"If you are the largest player, if you have scale, people will come to you simply because you are the biggest," he said. "But if you are not the largest, you have to do something that is different.

"It has to be something that only you can do. The thing we can do that is different is the relationship we have with hundreds of thousands of vendors around the world."

To illustrate the point, he highlighted Amazon's "relationship" with Manhattan Toy Co, a toy manufacturer based in the US.

"We are their biggest customer in the US, but they were not available in China," Gurr said. "Then we worked to bring them here, initially through the Amazon Global Store service. Now through direct imports, Chinese customers can get products faster and cheaper."

Enticing one foreign brand to China might not be a big deal, but attracting 36,000 labels to the country in six months underlines the pull of Amazon, Gurr added. "That is what we can do,"

Since Amazon China launched its cross-border e-commerce service, there are now more than 3 million different overseas products available to shoppers on its site, an increase of 40 fold.

While the company declined to reveal revenue figures for its business here, the company did report that orders from Chinese customers hungry for high-quality foreign products topped 5 million during the past nine months.

But then, Amazon China has a solid infrastructure system. Employing 5,000 staff and based in Beijing, the online giant has 13 centers scattered across major cities in the country that deal with quality control issues, shipping and delivery services.

Still, data from iResearch Consulting Group, a market research and consulting firm, showed that the company accounted for just 1.1 percent of China's B2C market in terms of revenue in the first quarter of this year. During the same period in 2014, the figure was 2.1 percent.

"I am genuinely not worried because we are not chasing market share," Gurr said. "We have no problems at all saying the business isn't working ... we will simply move to other businesses. In the areas we genuinely want to play, we will see triple digit growth."

This style of management will be key to the company's success although there will be challenges ahead. One is the length of time it takes to make a decision here. "Sometimes, you just need to make one and move on," Gurr said.

Indeed, under his management, Amazon China's global sales business has taken off and it will expand even further after clinching deals to bring more US labels here, such as Rebacca Minkoff handbags and Enfagrow baby products. "This will ensure Chinese customers can buy authentic overseas products that are delivered to their doors," he said.

- Amazon's global approach has helped entice local shoppers

- China sees 10,000 new firms every day: official

- CSRC holds hearing for illegal stocks operations

- AVIC works to make Africa soar

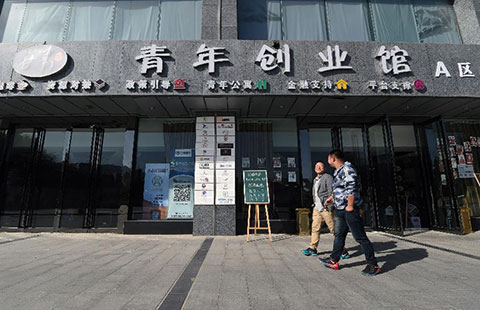

- Incubator centers set up to boost start-ups

- Dairy farmers in New Zealand hit by China's slowing economy

- Companies cash in on the trend for Western cooking

- Bakers cater to changing tastes