BP committed as trusted partner and valuable contributor to China

By LYU Chang (China Daily) Updated: 2015-10-19 13:26

|

|

|

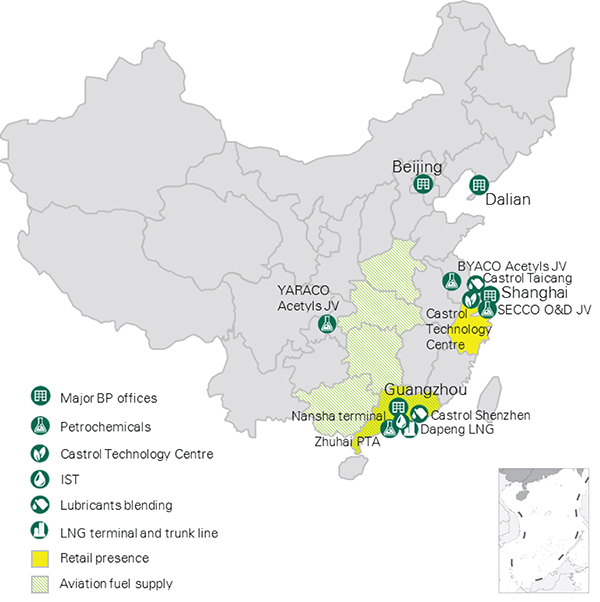

BP's presence in China. [China Daily] |

China's GDP has been expanding at the slowest growth rate since 2014. For this reason, some foreign companies have either cut their investment in China or moved their plants to China's neighboring countries to reduce costs. What is your plan for China next year?

BP continues to invest in China. It is a country of great significance to BP, given its size, rapidly growing economy and influence on the global stage. We are committed to contributing to China's energy solutions and to creating material value growth for BP by continuing to be a trusted energy partner both with China and within China. We will continue to actively seek attractive new opportunities with our partners inside and outside China. For example, in March, BP signed a strategic partnership agreement with Guangdong province. The agreement covers three areas of strategic importance to both parties-the petrochemicals value chain, the "green Guangdong" agenda and market liberalization. This strategic partnership is not an end, but a beginning.

What is your expectation for cooperation between Chinese oil and gas companies and their counterparts in the UK? Are you expecting any deal or agreement from BP during the period of President Xi's official visit?

We see great potential for enhanced cooperation and collaboration between both sides, particularly in the areas of technology, trade, and technical cooperation. High-level government visits help bring together new and innovative developments. For instance, last year during Premier Li Keqiang's visit to the UK, BP signed a deal worth around US$20 billion to supply CNOOC with liquefied natural gas (LNG). During President Xi's upcoming visit, we expect to sign a number of agreements with our Chinese partners, demonstrating our longstanding commitment to China.

Crude prices have been on a downward trend this year. Do you think this will last long or do you think it is only temporary?

We believe it is prudent to be prepared for continued low prices in the short-term. If you compare the oil price curve to a letter, I think the curve is neither an "L" nor a "V" but more like a flat "U". The biggest question for now is how long the bottom of "U" will last.

- 'Ghostly' goings-on attract business at Halloween

- B2C better model for China's ride-booking sector: UCAR

- Belt and Road will lead China to closer interaction with the world

- China's property investment continues to slow

- China's industrial output up 5.7% in September

- China's fixed-asset investment continues to slow

- BP committed as trusted partner and valuable contributor to China

- The Seventh Exposition Conference of Chinese Cities held in Hangzhou