China's e-commerce know-how benefits growing Brazilian sector

(Xinhua) Updated: 2015-10-26 14:50SAO PAULO - About 20,000 ePacket (EUB) parcels are delivered to Brazil every day from Yiwu, a large wholesale commodity provider in China's eastern coastal province of Zhejiang.

Yiwu has been named by the UN, the World Bank and J.P. Morgan, among others, as the "largest small commodity market" in the world, attracting a great number of international buyers.

"Most commodities sold along Sao Paulo's famous March 25 Street shopping district come from Yiwu," said Qiu Genjun, general manager of China Express Latin America Co Ltd.

In Brazil, EUBs are the result of close cooperation between China Post and Brazilian Post. Compared with around $76 per kg for UPS and around $110 for DHL to transport parcels from Beijing to Sao Paulo, it only costs about $22 per kg using China Post's airmail service, Qiu said, adding that other advantages of EUBs also include lower odds of package loss and faster customs clearance.

The EUBs have become a favored delivery method for AliExpress, of China's Alibaba Group, which has operated in Brazil since 2013 and has scored impressive results.

By the end of last year, AliExpress had been well ahead of the second-place B2W, a traditional Brazilian e-commerce group, and become the largest platform of its kind in Brazil, according to a report cited by local media.

The year of 2014 marked a good one for e-commerce development in Brazil, with trade volume surging 24 percent to reach 35.8 billion reais ($9.09 billion), according to a February report by a specialized company in e-commerce information, E-bit, which predicts e-commerce sales would reach 43 billion reais ($10.91 billion) by the end of 2015.

Brazil recorded some 10 million first-time online shoppers in 2014,bringing the total number of online shoppers in the country to 61.6 million, according to E-bit data.

Despite the rapid growth, the sector still faces challenges including a complex legal system and poor road logistics, said Michael Lee, Alibaba's head of international marketing and business development.

Language is also a main obstacle of the fast growing e-commerce market in Brazil. For example, though AliExpress has a website in Portuguese, the Brazilian shoppers still need to use English or translation softwares when they want to communicate with Chinese sellers for more details.

Tariff policies thwart the development of the e-commerce sector as well. The Brazilian government requires buyers to pay a 60-percent import duty on the cost and insurance (CIF) value of imported goods unless the CIF is below $50.

This makes many Chinese commodities more expensive than local ones and strips their competitive advantage, Lee said.

- Top 8 Chinese companies investing in UK real estate

- China's rate cut very different from QE: Central bank

- Understanding China's 'around 7%' growth target

- 6 Beijing metro stations to be integrated with retail

- All-new BMW 7 Series: the embodiment of dreams

- Rate cuts to spur economic growth, boost liberalization

- Volkswagen drives Shanghai's China Speed Weekend

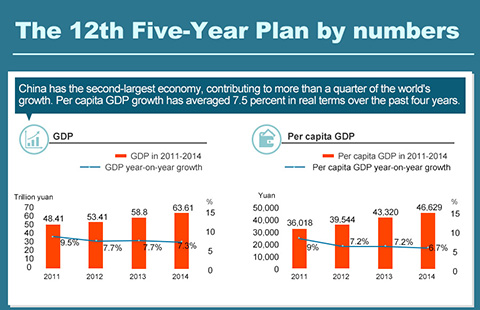

- The 12th Five-Year Plan by numbers