Rail firm on fast track to success

By Zhong Nan and Feng Zhiwei (China Dauly) Updated: 2015-11-16 07:11

|

|

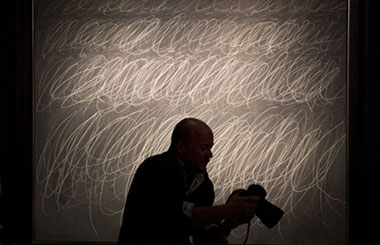

Passengers wait to board the train at Chan Sow Lin Station, a transit platform which is part of the Rapid KL Ampang Line in Malaysia. Trains used on the line were built by CRRC Zhuzhou Electric Locomotive Co Ltd. [Photo provided to China Daily] |

"After the first batch of 10 trains produced in China are delivered, engines of the same type will then be manufactured at our ASEAN base in Malaysia," Zhou said.

CRRC ZELC has three subsidiaries in the country, CRRC Kuala Lumpur Sdn Bhd, CRRC Kuala Lumpur Maintenance Co and CRRC (Malaysia) Railway Vehicles Co, which employ 320 workers. Up to 90 percent of the employees are Malaysians.

With a market share of 85 per cent, the company has become the largest rail equipment supplier in the country with close links to other members of the Association of Southeast Asian Nations.

But Malaysia is not the only overseas market. CRRC ZELC has also invested and built two manufacturing and maintenance plants in Turkey and South Africa during the past two years.

In 2014, it received eight major export orders worth a total value of 19 billion yuan. Still, foreign sales accounted for just 5 percent of its annual operating revenue.

Hopefully, that figure will jump to more than 30 percent this year although further financial details have yet to be released by the company.

In the ASEAN region, CRRC ZELC's main markets are Singapore, Indonesia, Thailand and naturally Malaysia, with rising demand for electric locomotives and mass transit trains for city and suburban lines.

"Even though a lot of money can be made from selling trains, providing maintenance services can also be very profitable," Luo Chongfu, vice-general manager at the company, said, adding that engines need to be sent for large-scale maintenance service after a year.

Competition in the sector, though, is fierce. Foreign rivals such as Siemens, of Germany, Alstom Group, of France, and Bombardier Inc, of Canada, have global service networks.

This in turn boosts their revenue figures in major overseas markets in Asia, the Middle East and Europe.

By 2016, the world rail and transit industry will be worth $240 billion, with maintenance services accounting for half that figure, according to a study by Paris-based International Union of Railways in July.

"The tactic of establishing an ASEAN rail center in Malaysia is based on our market share in the country and its geographical location," Luo said. "The relatively developed infrastructure (in China) could help us further develop neighboring markets such as Indonesia, Thailand and the Philippines."

CRRC ZELC has already supplied 18 metro engineering maintenance trains to Singapore and they are now being used on the city-state's urban rail network.

"The China-ASEAN economies will count on enhanced regional cooperation, especially in rail transportation, to stimulate trade and attract investment while improving regional economic integration," Zhao Jian, a professor of rail transportation at Beijing Jiaotong University, said.

Indeed, improving rail infrastructure comes at a crucial time with developed countries relying on emerging markets to revive the global economy.

"Ongoing plans by Singapore, Indonesia and Malaysia to build a high-speed rail link will further fuel the hope that Southeast Asia could one day have a similar European-style train system," Zhao, at CRRC ZELC, said.

With his eyes firmly fixed on future orders, Zhou is predicting that ASEAN countries will need 1,100 new carriages and refurbishment for another 700 during the next five years.

"Our new ASEAN rail base in Malaysia will give us an advantage to tap further into this lucrative market," he said.

- Chinese car market maintains growth

- Alibaba sets world record for auto sales in one day

- Guideline promotes fair competition, acts to defeat monopolies

- Many thousands submit views on China's car-hailing services

- Experts say return of margin traders a boost but risky

- A-share pricing needs to be right for overseas investors

- 'New wind' plan could help save energy

- Online shoppers hungry for healthy options