Innovative, small businesses get multibillion-dollar tax cuts in China

(Xinhua) Updated: 2015-11-20 09:59BEIJING - Chinese firms received tax cuts totaling 237.5 billion yuan ($37.2 billion) in the first three quarters as a result of government policies to spur innovation and mass entrepreneurship, the tax administration said Thursday.

Millions of businesses have seen their taxes reduced, according to the State Administration of Taxation.

In the first three quarters, the government slashed the corporate income tax rate from 25 percent to 15 percent, which affected 96.5 billion yuan of taxes on high-tech companies, the administration said.

Tax exemptions and breaks on small enterprises reached 73.3 billion yuan. Tax cuts designed to encourage spending on research and development totaled 44.4 billion yuan, according to the administration.

Industries related to technology transfer and commercialization also enjoyed billions of yuan of tax breaks.

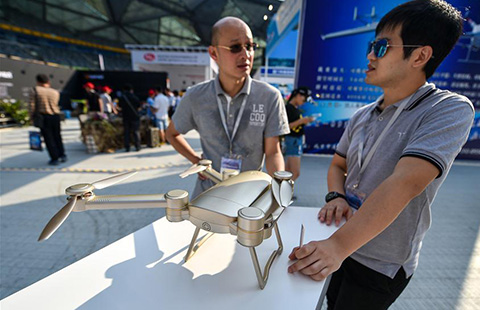

In the face of economic headwinds, China is counting on entrepreneurship and innovation to generate new jobs and improve the skill set of its citizens, and warm up the slowing economy.

A State Council executive meeting decided last month to further optimize its preferential tax policies for firms engaged in research and development in 2016.

- China EximBank to finance China Railway's global projects

- China to reinforce IPR protection: vice premier

- China shifting to nation of consumers: expert

- China's auto market feels global chill

- China leading in clean energy investment: EF CEO

- China's Wanda completes merger of World Triathlon Corporation

- Beijing Capital plans more overseas M&As

- China's central bank cuts SLF interest rates for local branches