At China-initiated AIIB, openness begets confidence

(Xinhua) Updated: 2016-01-16 15:27BEIJING - The open nature of the Asian Infrastructure Investment Bank (AIIB), an initiative of China, has inspired confidence around the world.

For the little remaining skepticism over whether the bank will have sound lending standards, there are plenty of reasons to stay optimistic.

The fundamental reason is that the institution cannot be more representative, diverse and multilateral in nature. This also explains the bank's vigor and lure.

Recall the moment when the developed countries of Europe decided to join the bank last year. Some of them called for maximum accountability and transparency in the bank's governance structure and day-to-day operations.

China welcomed the countries to join, and the reason is simple: accountability and transparency are what China wants too.

From the start, the AIIB, based on a vision of Chinese leaders, was envisaged to "promote interconnectivity and economic integration in the region" and "cooperate with existing multilateral development banks."

The vision is in line with China's pursuit of inclusive development over the decades. Contrary to the opinions of some observers, China has not sought to counterbalance the influence of other countries but instead seek common development. Better connectivity benefits countries in the region, and when they grow, China grows too.

The bank's purpose is to respond to the development needs of Asia. It is estimated that the gap in funding for infrastructure projects in the region will amount to some $800 billion per year over the next few years.

Drawing on China's infrastructure prowess, the bank seeks to mobilize resources from both within and outside the region, and from both the public and private sectors. It will operate on market principles.

A number of developed economies, especially from Europe, joined the initiative last year, along with a slew of developing countries. Such a diverse group of members in a multilateral institution initiated by a developing economy not only means that the bank is inclusive: it also illustrates its highly democratic nature, a sentiment echoed by participating countries during early negotiations.

China has made it clear that it does not seek to be the bank's dominant player. "It is not going to be China's bank. It will be jointly owned by its members," said Jin Liqun, the bank's president-designate.

Jin said that it will be clean, green and transparent and aspire to achieve the highest standards of good governance. Most of the doubts and concerns have disappeared as more and more countries jump onboard and more and more details unveiled on voting rights and board composition.

The bank officially begins operating with a ceremony and the first board of governors and board of directors meetings this weekend. It is expected to offer its first batch of project loans by mid-2016. Once again it demonstrated openness by exploring possibilities of co-financing with other multilateral institutions such as the Asian Development Bank.

The projects reportedly could be related to transportation, such as roads, renewable energy, urban development, and water -- an obvious focus on sustainable development that should enhance confidence in the projects' high environmental standards.

- Opening ceremony of AIIB launches in Beijing

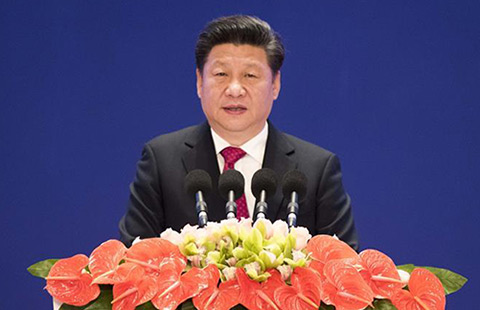

- Chinese President Xi calls AIIB's launch 'historical moment'

- Infographics: Asian Infrastructure Investment Bank

- AIIB to serve new effective multilateral channel for Vietnam, China to communicate

- AIIB to make substantial contribution to global economic governance

- Baidu faces punishment over porn, fake adverts

- China starts beef imports from Hungary

- CSRC chair comments on China's trading flaws

- Opening ceremony of AIIB launches in Beijing

- Guangxi reports 15% rise in foreign trade

- China Southern Airlines, Huawei win Dutch govt award

- Energy chief promises less polluting power plants

- Oil prices plunge below $30 amid supply glut