Increase in fixed-asset investment pledged

By WANG YANFEI (China Daily) Updated: 2016-02-18 02:28

|

|

Rail tracks are laid on a route in Nantong, Jiangsu province. [XU CONGJUN / FOR CHINA DAILY] |

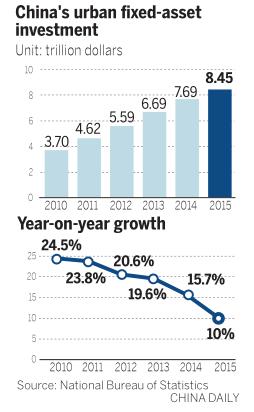

Investment in public programs has been a main method for China to keep up its GDP growth. But in year-on-year terms, its investment in fixed assets amounted to 55.1 trillion yuan (nearly $8.5 trillion) last year, showing a growth of only 10 percent, down from a growth of 15.7 percent in 2014 and 20.6 percent in 2012.

Fixed-asset investment in the manufacturing sector grew by only 8 percent last year.

In an attempt to prevent too rapid a decline from upsetting the whole economy, the central government has injected 5 trillion yuan, since February 2014, into the programs it selected for industrial and public service development.

In January alone, a new commitment of 54.1 billion yuan was made to such programs, said Zhao Chenxin, the NDRC spokesman, on Wednesday.

"The investment projects that the central government approved are mainly designed to improve people’s livelihood," Zhao said, such as expanding the power supply and building more waterworks.

The investment programs led by central government cover 11 areas, of which the development of information and energy networks has already cost around 1.56 trillion yuan, while 1.2 trillion yuan has been spent on transportation systems.

The other areas include clean energy, environmental protection, energy and mineral resources, health and retirement care services, logistics, urban rails, technology industries, and what Zhao described as projects to boost the core competitiveness in the manufacturing industry.

Economists said that despite the economy’s intended transition and an inevitable slowdown, "appropriate stimulus", especially investment in projects of strategic importance, would still be needed to allow China to keep up its growth momentum and meet demands in the future.

However, it is unlikely that such investment will see a major increase in overall terms, said Zhou Dadi, former director of the NDRC’s Energy Research Institute, "because there are industries asked by the central government to divest some of their existing capacity and to reduce their workforce."

There is no point in increasing investment in steel and coal industries, he added.

According to Liu Yuanchun, associate dean of the School of Economics of Renmin University of China, Beijing, the country cannot afford to completely stop financing fixed asset investment because such investment will benefit the economy in the long run.

Last year’s growth rate in fixed asset investment was already too slow, said He Zhicheng, chief economist at Agricultural Bank of China.

"It would be dangerous to let it slide below 10 percent."

- China January consumer prices up 1.8%

- China producer prices down 5.3% in Jan

- Aston Martin to develop electric car with China's LeEco

- Aviation giants confident in Chinese market's growth potential

- TCM makers welcome state support

- G20 trade ministers to meet in Shanghai in July

- COSCO declared preferred investor for Greek Piraeus port privatization

- Investment in water projects to top 800b yuan in 2016: NDRC