China's banks handed guideline on steel, coal industry lending

(Xinhua) Updated: 2016-04-21 20:17BEIJING -- China has ordered its banks to adopt a differentiated approach to loans to companies and individuals affected by the reorganization of the over-capacity steel and coal industries.

Lenders should ensure they meet reasonable capital demand but halt loans to loss-making enterprises, according to a guideline jointly released by financial regulators including the central bank on Thursday.

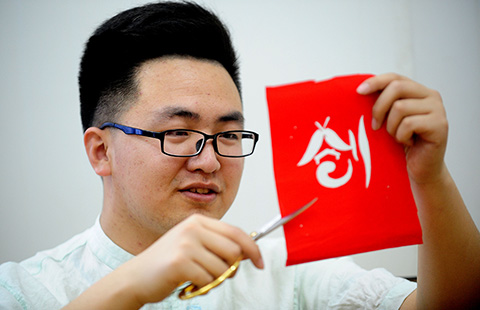

The guideline allowed loans to companies capable of repaying debts to be rolled over to help them weather hardships, and it encouraged lending to laid-off workers starting their own businesses.

Banks should help deal with corporate debts and non-performing assets through debt restructuring and bankruptcy liquidation and prevent isolated cases from growing into systemic and regional risks, the guideline said.

The document was released by the People's Bank of China, China Securities Regulatory Commission, China Banking Regulatory Commission and China Insurance Regulatory Commission.

- Second-tier cities see biggest increase in home prices in March

- Financial and technology companies ranked most authentic brands in China

- Chinese banks' forex sales rise mildly

- Alibaba to expand operations to Australia

- China's domestic capital dominates real estate investment market

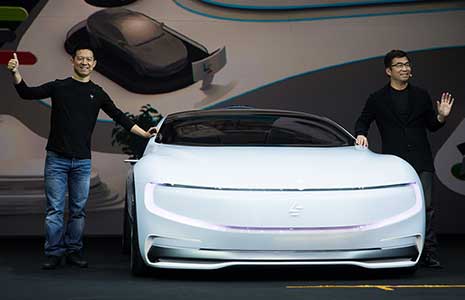

- LeEco rolls out tech breakthroughs

- Business jets market projected to become multi-billion sector

- Concerns of China nearing debt crisis overblown: Report