Stocks fall most in nearly two months

By Cai Xiao (China Daily) Updated: 2016-04-22 06:59Analysts blame tight market liquidity and upcoming tax reform

Chinese mainland stocks sank the most in almost two months on Wednesday, with experts saying tight market liquidity, upcoming value-added tax reform and technical adjustment may be the reasons.

The Shanghai Composite Index dropped as much as 4.5 percent, the biggest loss since Feb 29, before paring declines to 2.3 percent at the close. The Shenzhen Component Index declined 4.1 percent, while the ChiNext startup index plummeted 5.6 percent.

Telecommunications, media and technology companies led the decline as Zhejiang Huace Film & TV Co and Huayi Brothers Media Corp slumped 7.7 percent and 6.3 percent, respectively. Telecom giant China Unicom Ltd fell 3.2 percent.

"Tight market liquidity may be a reason of today's stock market slump," said Hong Hao, managing director and chief strategist at BOCOM International Holdings Co.

Hong said even though the People's Bank of China, the country's central bank, auctioned 250 billion yuan ($38.7 billion) of seven-day reverse-repurchase agreements on Wednesday, it is not enough to make up for the shortfall.

Hong added that given the improving economy and fast credit growth, it lowers the chance for the central bank to cut the reserve requirement ratio in the near term.

"Another reason can be the upcoming value-added tax reform," said Hong, adding that the reform will actually make it more difficult to evade taxes, and thus increase the tax burdens for financial institutions.

The reform to replace business tax with VAT in service sectors will expand to four areas: construction, real estate, finance and consumer service. The reform is set to begin on May 1.

Zhu Daoqi, executive partner at Shanghai Winstyle Investment Management Center, said technical adjustment may cause the slump.

"Gauges of 20-day price swings on the Shanghai Composite, the Shenzhen Component, and startup index make fund managers with technical analysis decrease positions," said Zhu.

Hong said the Shanghai Composite Index will be between 2,500 and 3,300 this year as economic fundamentals should be better improved.

Ren Zeping, chief macroeconomic strategist with the brokerage firm Guotai Junan Securities Co, said they look good on Chinese A-share market from now on and there are opportunities in the spring season.

"We make the prediction because China's economic recovery is higher than expectation," said Ren.

"Besides, there are some credit violations in the bond market and the real estate market has limits, so stock market is a destination for Chinese investors."

- New Zealand kiwifruit giant looks to China for year-round supply

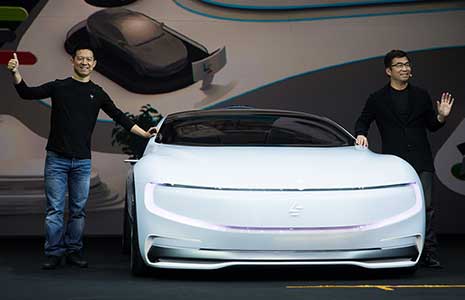

- Latest technologies dazzle at Shanghai tech-fair

- Wanda promises 12% return to investors backing the buyout

- China's urban unemployment rate at 4.04%

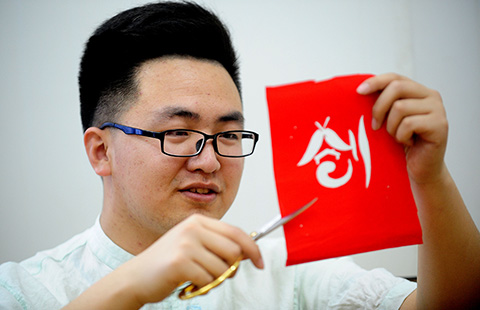

- China's free trade zones pilot reforms for efficiency and openness

- New Zealand tourist industry excited by multi-million-dollar deal with China

- China eyes more say in global gold pricing with new benchmark

- Falls in yuan seen as 'stable' by foreign exchange watchdog