Vanke's shares plunge in HK on reported move to oust chairman

By ZHU WENQIAN (chinadaily.com.cn) Updated: 2016-06-27 13:42

|

|

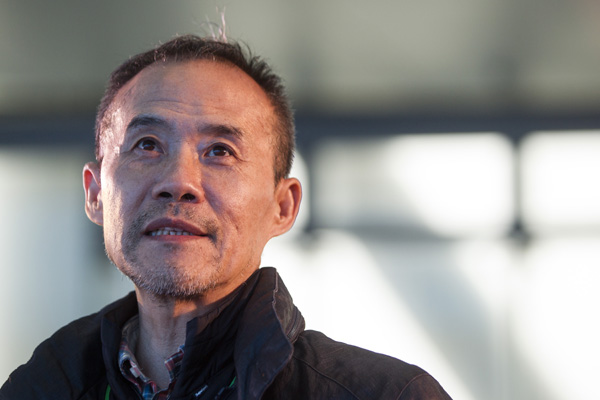

Wang Shi, chairman of China Vanke Co, attends the World Water Day Forum in Guangzhou, South China's Guangdong province, March 22, 2016. [Photo/VCG] |

Vanke stocks fell nearly 5 percent during intraday trading, and it managed to bounce back slightly and closed at HK$ 16.04 ($2.07) for midday closing, down by 3.95 percent.

On June 24, the company received a notice from Shenzhen Jushenghua Co Ltd, and Foresea Life Insurance Co Ltd, units of Vanke's current largest shareholder Baoneng Group. The two investors together hold 24.29 percent of Vanke's total issued share capital.

Vanke's plan to buy assets from State-owned Shenzhen Metro Group Co Ltd, by issuing new shares to the latter, and potentially make it the largest shareholder, has faced strong opposition from Baoneng, who said the deal would dilute the interests of current shareholders. It said Vanke's board isn't representing shareholders' interest in a balanced way.

Besides, the proposal said Chairman Wang studied abroad in the United States and the United Kingdom from 2011 to 2014. He had been out of work for a long time, but still got cash rewards for more than 50 million yuan ($7.58 million) from Vanke, which harmed the interests of the company and investors.

The property giant said in a statement on Sunday to Hong Kong stock exchange that it will hold a board meeting within 10 days from receiving the request, to decide whether to convene an EGM.

- China's service trade deficit narrows in May

- Industrial park projects to boost international ties

- Chinese brands becoming household names in Australia

- China to continue opening up to aid economic transition: Premier

- Premier promises steel, coal capacity cuts

- Premier Li calls for reform to revive world economy

- New driving force bringing momentum to economy: Premier

- China mulls allowing more to practice asset appraisal