China's start-up board turnover continues to gain

(Xinhua) Updated: 2016-08-08 10:02

|

|

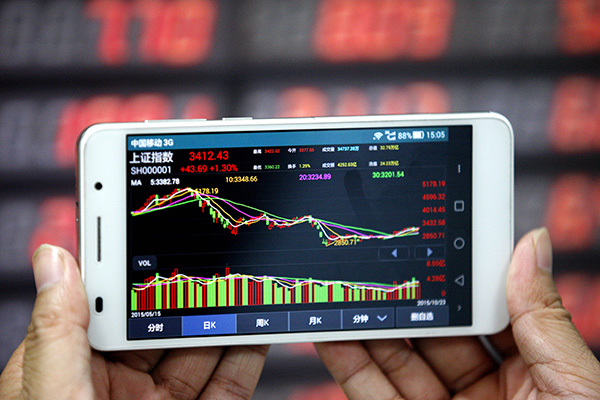

A stock indicator shows the benchmark Shanghai Composite Index on Oct 24, 2015. [Photo by Xie Zhengyi/Asianewsphoto] |

BEIJING - Total turnover on the National Equities Exchange and Quotations (NEEQ), the market for Chinese startups to raise funds, continued to increase in the past week.

From August 1 to 5, NEEQ's trading volume climbed 7.75 percent week on week to 3.12 billion yuan (around $470 million).

Four companies recorded transactions worth of more than 100 million yuan each. Donghai Securities, a small brokerage headquartered in the eastern city of Changzhou in Jiangsu Province, was the biggest winner with shares worth 800 million yuan traded.

During the week, 231 companies debuted on the market, bringing the total number of NEEQ-listed companies to 8,147.

More small firms are turning to the NEEQ for financing as the government promotes a multi-level capital market to satisfy growing financial demands from both large and small companies.

However, the benchmark NEEQ Component Index edged down 0.06 percent to 1,161.9, the lowest level year to date.

NEEQ was launched in Beijing in late 2012 and is also known as the "new third board" that supplements the main Shanghai and Shenzhen bourses.

- NYC now world's most expensive city to live in: Real estate agency

- Talent in hot demand as huge investment pours into e-car industry

- Second-hand sector stalls as cities delay policy stimulus

- Volkswagen backs removal of stake cap

- Tesla S crash driver blames Autopilot

- Legalizing of car-hailing services will hit sales

- Here come Chinese tourists - and they aren't shopaholics

- End of an era as China's love affair with US real estate fades