Mondelez to invest $100m in China

By Wang Zhuoqiong (China Daily) Updated: 2016-08-18 07:45

|

|

The headquarters of snack food maker Mondelez International Inc in Deerfield, Illinois, the United States on August 9, 2014. [Photo/IC] |

Global snack leader Mondelez International Inc is investing more than $100 million in the next three years in China to manufacture and launch its new chocolate brand to cash in on the country's growing $2.8 billion market.

Europe's much-loved Milka brand will hit shelves in China in September as Mondelez's first chocolate brand in the country, with taste and flavor adapted to local customers.

Mondelez has spent four years preparing its Chinese products to stand out from Mondelez's global chocolate brands portfolio, which include Cadbury Dairy Milk, Lacta and Toblerone, said Manu Anand, president of chocolates Asia Pacific at Mondelez.

He added market research has shown Chinese consumers prefer Milka's characteristics of quick-melting, rich chocolate quality and an Alpine milk taste.

"The investment is ongoing and the first three years will be more than $100 million," said Anand.

The investment also includes capital to create jobs, manufacturing, marketing and upgrading its new distribution system of cold chains, said Cesar Melo, president, global chocolate team at Mondelez.

"Almost all Milka chocolate sold in China will be made in China with Alpine milk imported from Europe," said Anand.

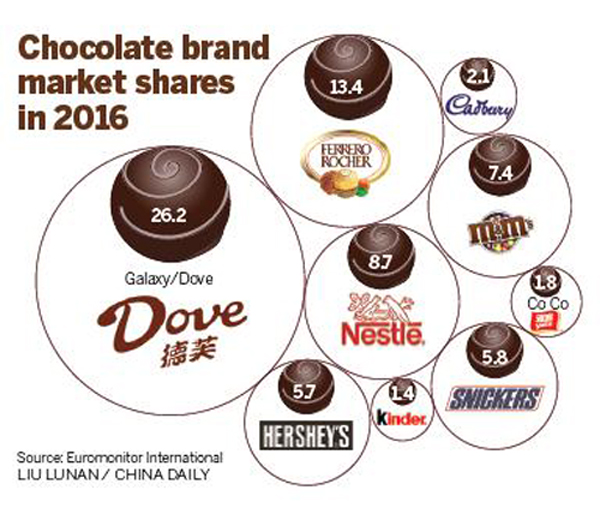

According to Euromonitor International, Mars Inc's Dove brand tops chocolate market shares in China in 2016 at 26.2 percent, followed by Ferrero Group's at 13.4 percent and Nestle SA at 8.7 percent.

Du Jiaqi, research manager of Euromonitor, said the chocolate category has had soft growth in China in the past year, falling 3 percent year-on-year.

"Chocolate is an impulse purchase," said Du. "The weakened gifting behavior combined with impact of e-commerce, where consumers don't notice chocolate like in a store display, has lowered consumption in the category."

However, China still has huge potential to grow the demand to match the level of Europe in terms of consumption per capita.

Jason Yu, general manager of Kantar Worldpanel China, said: "Through smart demand segmentation, Milka can find some unique space in consumers' minds. Of course, it cannot be a 'me too' brand."

Having operated in China for more than 30 years, Mondelez has had to deal with the issue of its aging brands by introducing fresh categories in the past several years.

"With Mondelez's biscuit business experiencing saturation, it is critical for the company to look for new business drivers," said Yu. "The addition of Milka is expected to improve its profit margin."

- Crew members of bullet trains in E China prepare for G20 Summit

- India's Hike wins Tencent backing for $1.4b valuation

- China's Huawei opens Southern Pacific OpenLab in Singapore

- Tencent reports strong second quarter revenue growth

- Chinese-made helicopters fly into the sky

- Trading link 'hastens MSCI'

- Ikea to launch e-commerce business model in Shanghai

- Shanghai land sold at highest price on record