China sovereign wealth fund CIC invests in German homes

(Agencies) Updated: 2016-10-24 10:17Oct 21 China's sovereign wealth fund CIC has made a large investment in German residential real estate, adding to a string of recent buys of Chinese groups in Europe's largest economy, sources close to the deal said on Friday.

German property group BGP has been sold to vehicles advised by Morgan Stanley Real Estate Investing (MSREF) at a value of more than 1.1 billion euros ($1.2 billion) including debt, BGP said in a statement.

The bulk of the money involved in the deal came from CIC, two people close to the transaction said.

CIC was not available for comment after regular business hours.

China's shopping spree in Germany has hit the headlines this year with, among other acquisitions, Midea's 4.5 billion euro purchase of industrial robot maker Kuka.

The BGP buy, however, is the first major Chinese investment in German homes.

CIC and its co-investors beat out German property groups Vonovia and Deutsche Wohnen in the auction for BGP. A stock market listing had also been mulled as a divestment option.

In August 2015, a planned sale of BGP to Austria's Conwert fell apart.

BGP's apartments are located mainly in Berlin and North Rhine-Westphalia. The flats had represented one of the few large German property portfolios in private hands that had been up for sale.

BGP was formed in 2005 as a joint venture between Australian investment group Babcock & Brown and property group GPT and at one stage was worth 4 billion euros. But many of its assets have been sold off.

Babcock & Brown was liquidated in 2009, and GPT shareholders received shares in BGP. These securities were held mainly by funds and 58,000 primarily Australian retail investors.

Lazard advised the sell side on the transaction

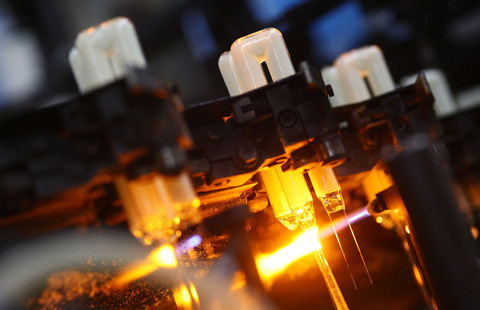

- Steel giants hit by losses see hope in complementary businesses

- On a big mission to make healthcare accessible to all

- Pearson sales fall on US courseware slump

- Yuan to finance shekel startups

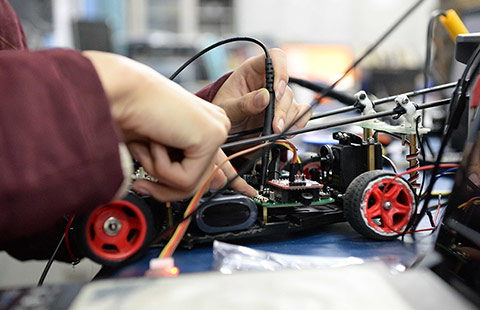

- Smartphone makers turn to offline retail

- Tmall going for luxury during 11/11 mega sale

- China warns of property-related financial risks

- New energy vehicle output, sales gear down in China